Travel was one of the hardest-hit industries in 2020. Due to interstate, national, and global travel restrictions brought on by COVID-19, no part of the Travel industry was spared from extreme marketplace shakeup.

In our 2021 Mobile App Engagement Benchmark Report, a study of 1,000 apps across a billion+ app installs, we take a close look at apps in the Travel category. Travel apps are segmented into three subcategories (Transportation, Hospitality/Tourism, and Auto) to provide a deeper look at different industries fared. Almost all Travel apps in our study experienced significant change in consumer engagement, customer retention, daily active usage, emotion-based feedback, consumer interactions, ratings and reviews, and more.

At a high level, the subcategories of Transportation and Hospitality/Tourism apps faced immense challenges that reflect in their consumer data across the board. The Auto subcategory fared better than the rest, with most of its benchmarks at or slightly higher than macro averages.

Read on for data-supported research and benchmarks Travel apps should focus on in 2021 and beyond based on what was learned from a year like no other.

2021 Engagement Benchmarks for Travel Apps

Ratings and Reviews

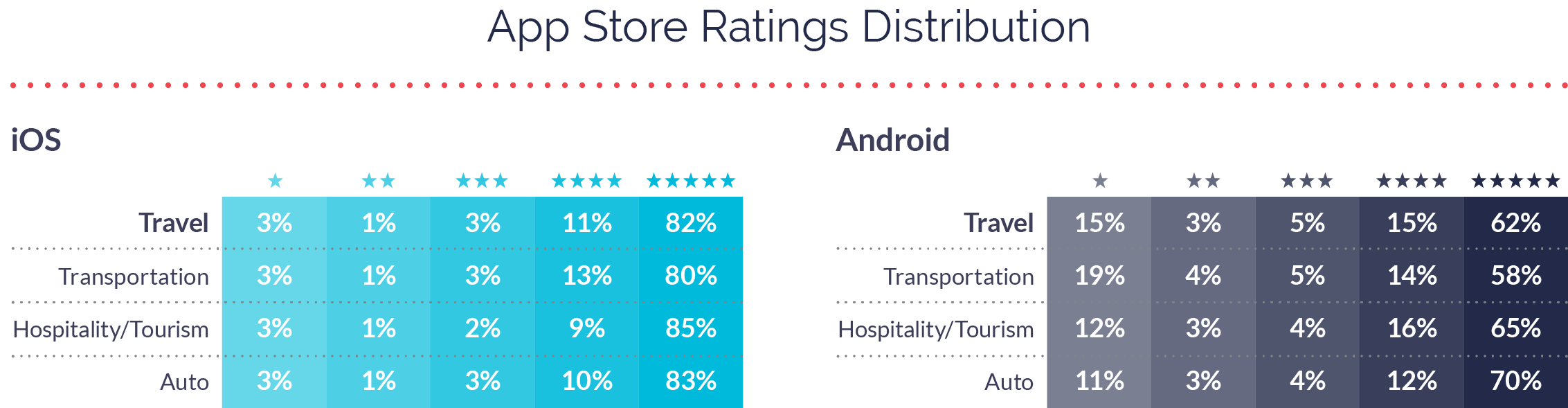

Travel apps ratings and reviews were around or even slightly higher than macro app averages. The average iOS app saw a whopping 243,532 app store ratings, received a 4.67 star rating, and received 381 app store reviews. Android apps saw many fewer ratings (19,673), received a 4.05 star rating, and had 1,335 reviews.

Similarly to previous years, iOS apps again enjoyed a higher overall rating; however, Android narrowed the gap between two in 2020, likely due to the new weighting system that Google employed in late 2019.

The big takeaway for Travel apps is while you can’t mitigate every negative rating or comment, having a plan in place to directly receive negative feedback will help you improve your numbers.

Retention

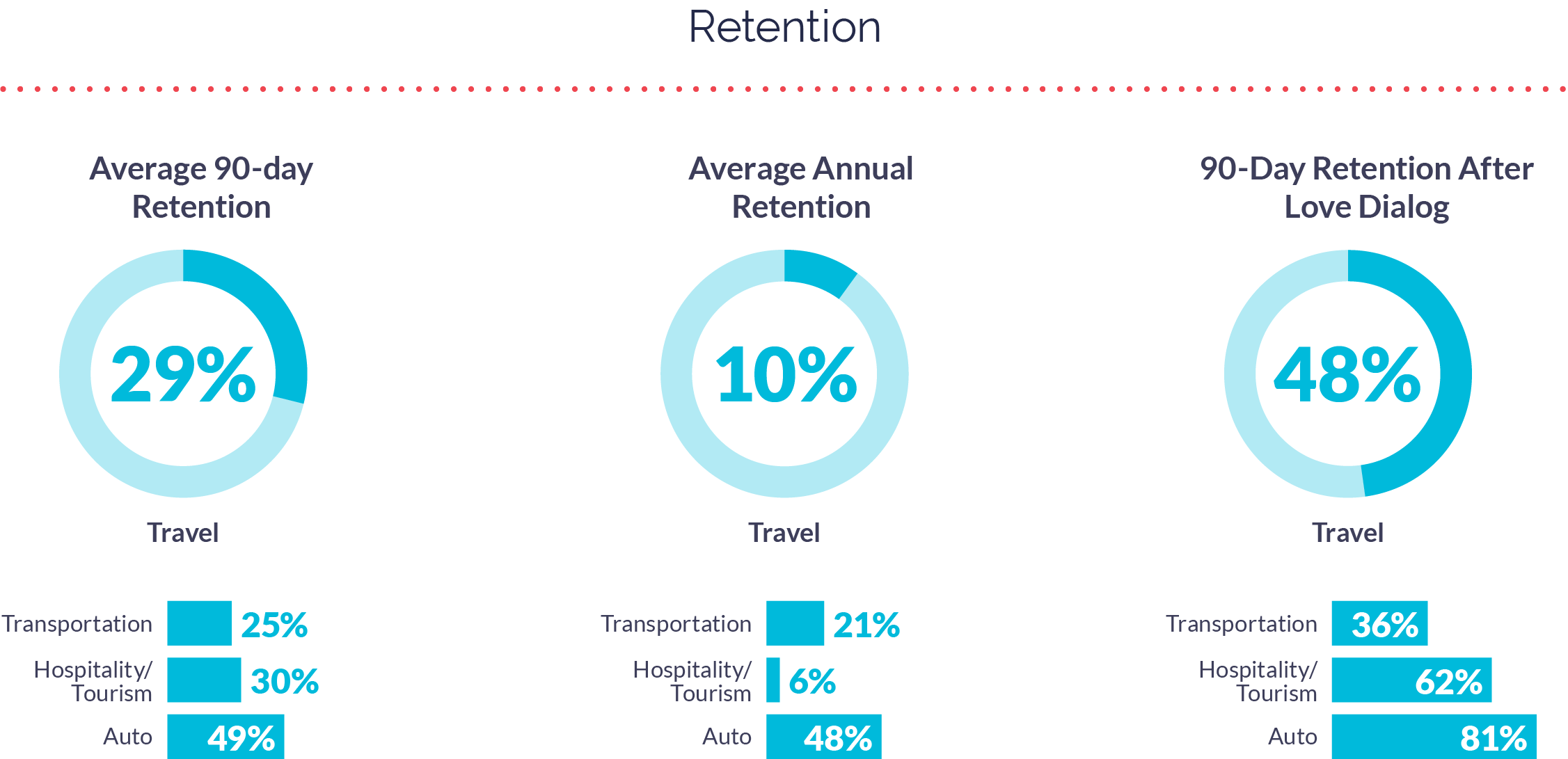

While Travel apps ratings and reviews were around or even slightly higher than macro averages, consumer retention tells a concerning tale. The impact global lockdowns had on Travel apps can be undeniably seen in their retention numbers.

90-day retention for Travel apps was lower than the macro average at 29% (average is 48%), with Transportation apps falling as low as 25%. For comparison, Travel apps had a 90-day retention rate of 43% in 2019—a -33% year-over-year decrease.

Annual retention is even more concerning at 10%, well below the macro average of 35%. Again for comparison, annual retention for Travel apps in 2019 was 34%—a 71% year-over-year drop. Transportation apps performed slightly better at 21% although still below average, and Hospitality/Tourism apps were critically impacted, ending the year at 6% annual retention.

Obviously many factors contributing to the drops in Travel app retention were outside of mobile teams’ control. Consumers either jumped ship or were considered “churned” due to inactivity. While concerning, this is a solvable problem for mobile teams in 2021 as people slowly begin to travel again.

Interaction and Response Rates

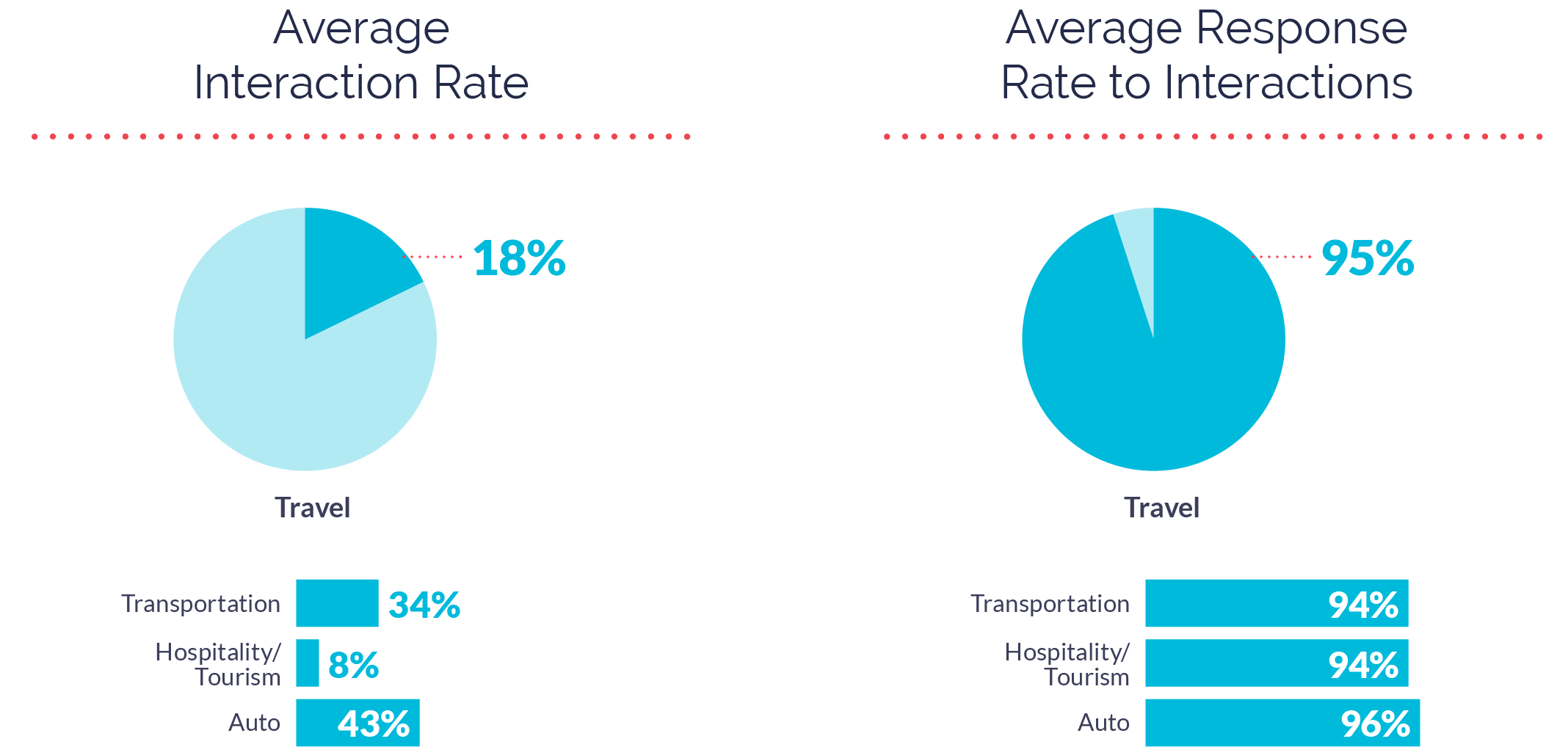

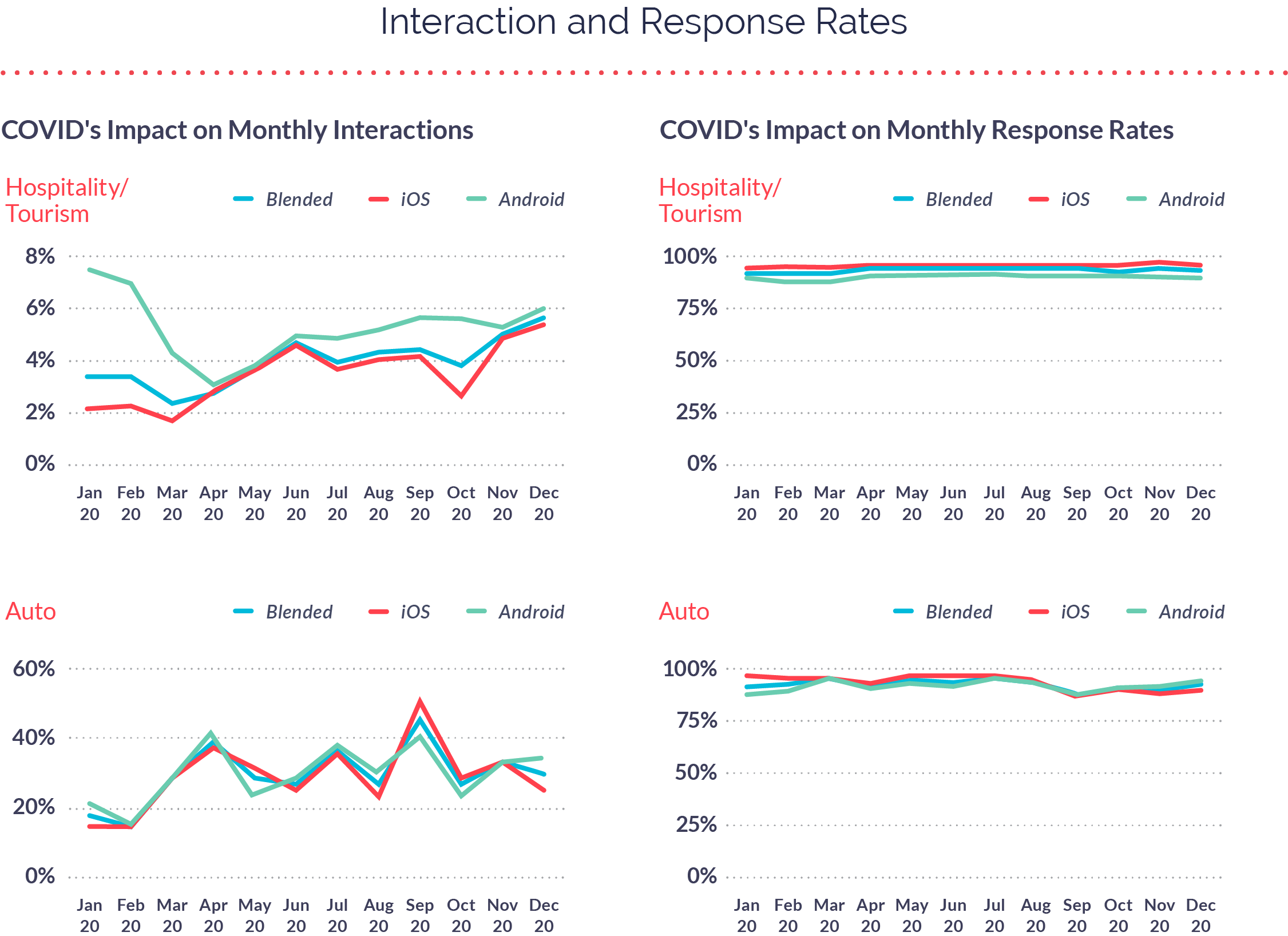

COVID-19 had the strongest negative impact on interactions in Travel apps over all other app categories in our research. Interaction rates for Travel apps were 18%, lower than the macro average of 26% (Hospitality/Tourism was most impacted with an interaction rate of only 8%).

Most Travel apps’ monthly interactions were impacted heavily through May then began to slowly recover, reaching January levels nearing the end of the year. During Q1 and Q2, it was important for Travel apps to tone down their non-essential communication as COVID-19 restrictions changed their business, and most brands only communicated urgent changes to consumers. The uptick in interaction rates in summer and later months were strongly driven by brands communicating changes to consumers in their apps.

That said, Travel mobile teams deserve immense credit for their extremely high response rates (94%+ across all subcategories) that held steady throughout the year. These teams clearly understand that when consumers reach out, responding to understand and act on emotion is the best strategy.

Popular Phrases

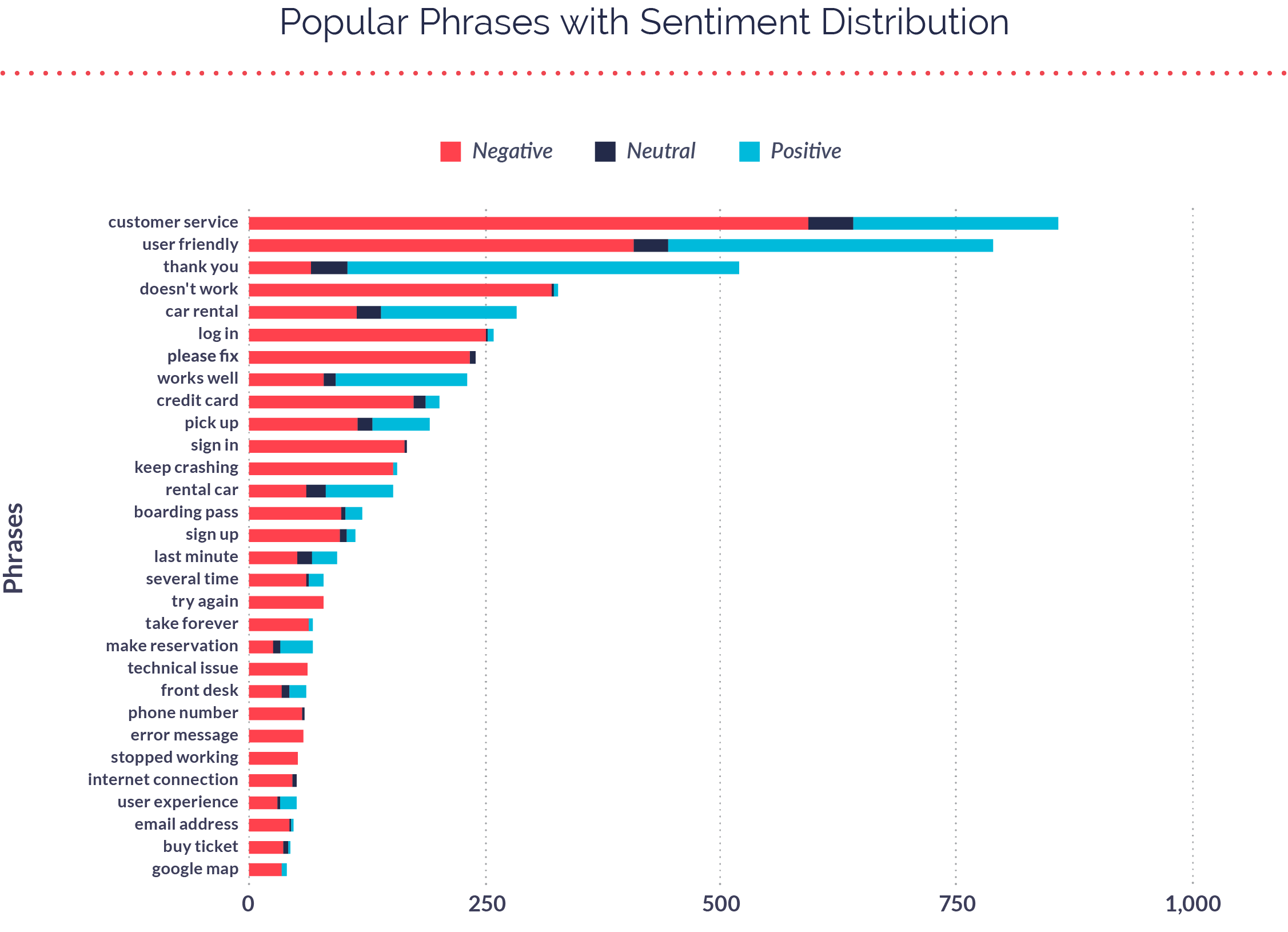

Shifting our focus to app store reviews. Below are the 10 most popular phrases in both iOS and Android app store reviews throughout 2020.

When we layer on sentiment distribution, you can see the difference between negative, neutral, and positive sentiment across app store reviews. The Travel app category is especially prone to negative sentiment through reviews due to the nature of their business; it’s easy for consumers to leave frustrated feedback in the moment, and even easier for them to forget about positive experiences once they conclude.

Mobile Consumer Sentiment

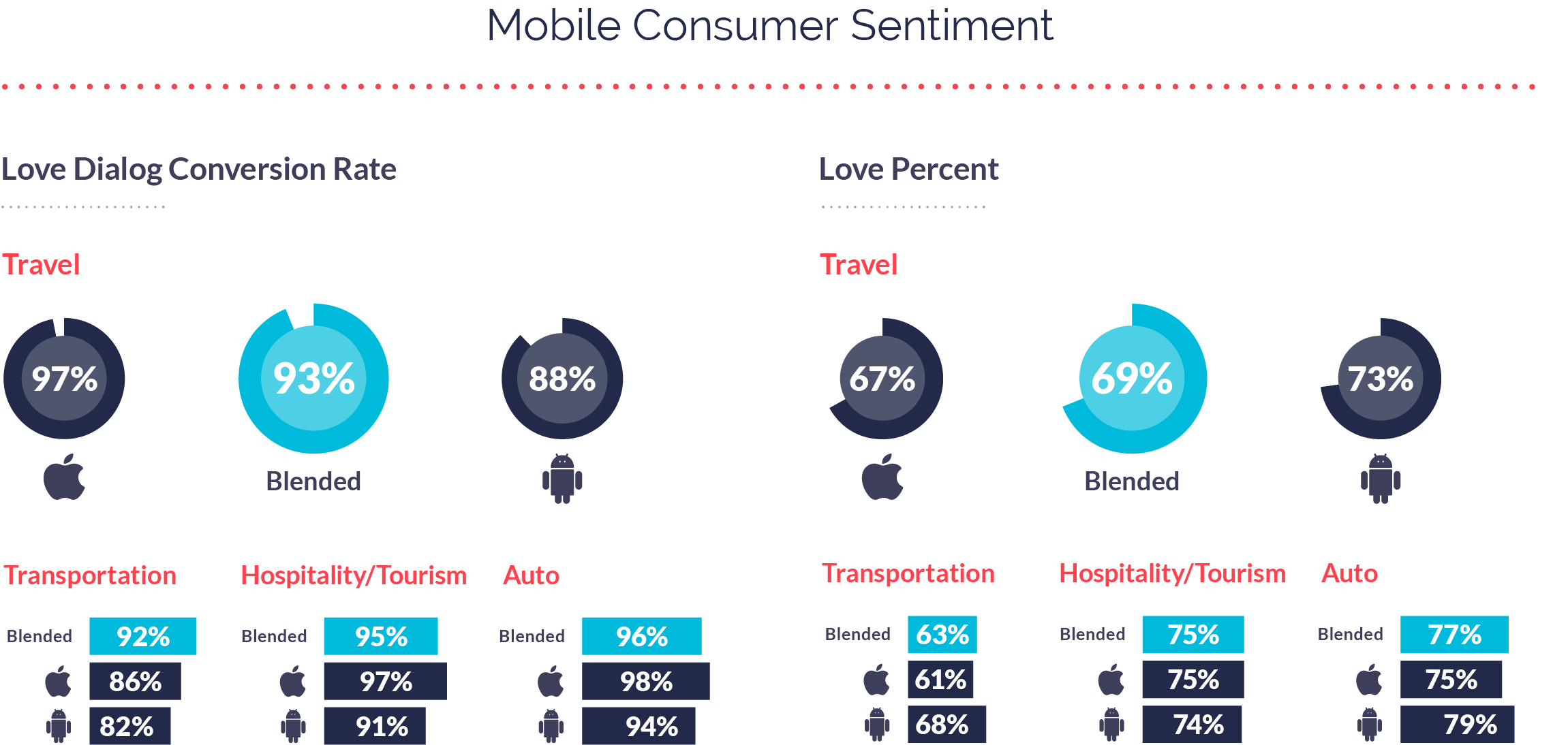

Gauging sentiment starts with understanding customer emotion. Alchemer Mobile (formerly Apptentive)’s Love Dialog feature is used to gather the data, which starts with a simple “yes” or “no” question: “Do you love our company?”

Travel apps’ consumer sentiment was mostly comparable to macro averages across Love Dialog conversion rate and Love Percent. In 2020, 93% of consumers who were prompted by a Love Dialog responded “Yes” or “No” rather than closing out of the prompt. 69% of consumers prompted responded that “Yes,” they loved the brand.

These quick, positive responses are a great way for brands to take a regular emotional pulse from their consumers, without asking them to leave the app for feedback or take another step away from their intended use of the app. They’re also a much better indicator of consumer happiness and potential lifetime value than lagging metrics like NPS.

Surveys and Messages

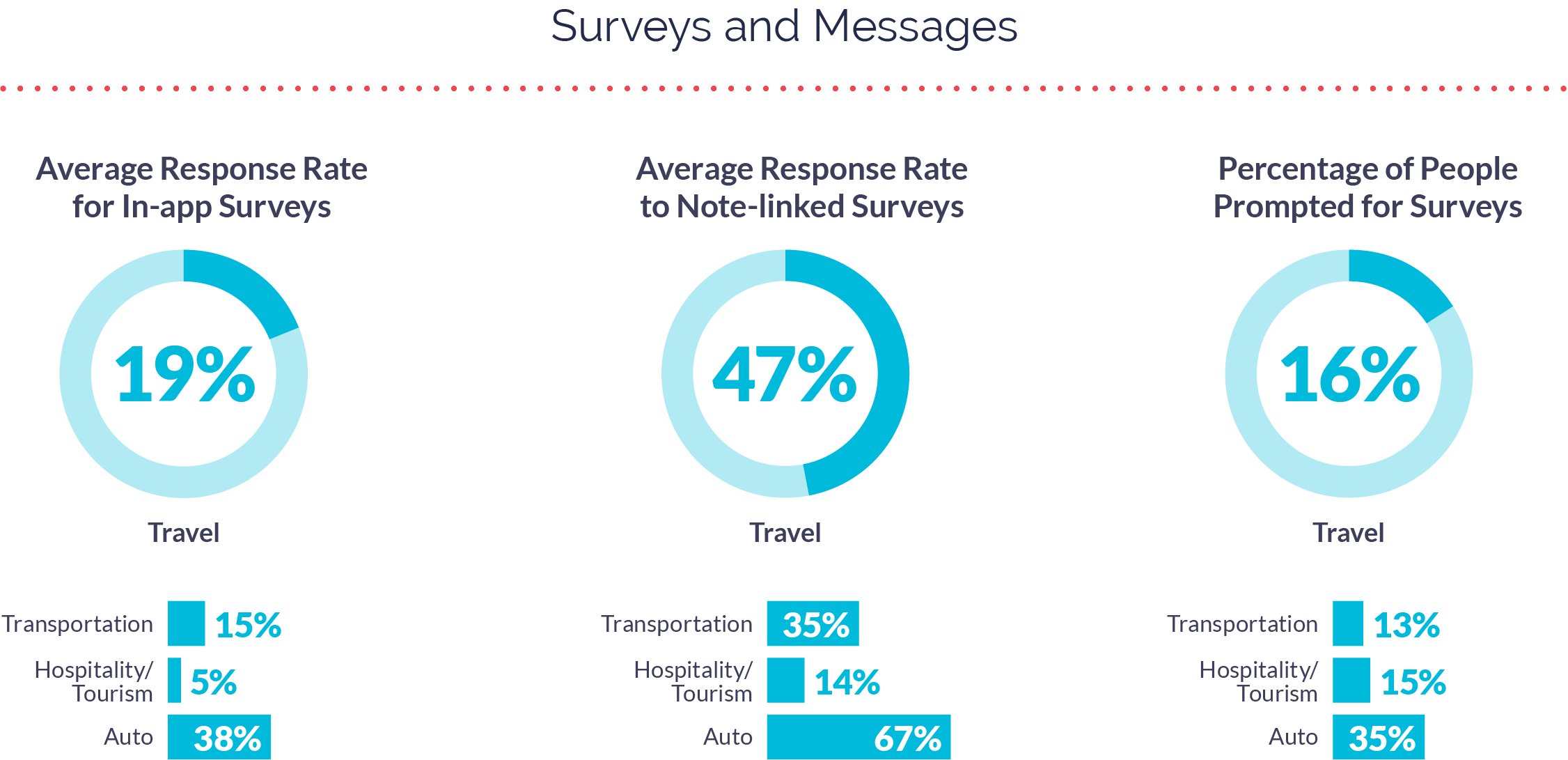

Survey response rates for Travel apps were higher than macro average (16%) for all subcategories other than Hospitality/Tourism (5%). Travel app response rates were lower than the macro average (60%) for both Transportation and Hospitality/Tourism. These apps also surveyed fewer people in 2020 (16%) than the macro average (25%).

The fluctuation across these benchmarks is likely due to a combination of consumer fatigue, making broader asks through surveys, or surveying at less opportune times throughout consumer journeys. Reasons for turning the dial back on surveys in 2020 was very business dependent.

Working in Mobile Travel in 2021

Travel apps in our study experienced significant change in consumer engagement, customer retention, daily active usage, emotion-based feedback, consumer interactions, ratings and reviews, and more. These changes were driven by a variety of unprecedented factors due to the coronavirus epidemic and generally had a harsh impact on the category.

As the data shows, Travel apps are beginning to recover, but still have a long road ahead. 2021 will be a year of repair for Travel apps as consumers begin to move around once more. For more on how mobile teams in Travel can win back market share and improve feedback-based innovation, read our 2021 Mobile App Engagement Benchmark Report.