Scale CX Programs and Embrace Digital Transformation

For today’s financial services firms, understanding your customers’ needs requires a seamless, multi-channel approach. Whether clients and members are engaging through online banking, mobile apps, call centers, surveys, or in-branch interactions, you need a CX platform that captures feedback across all touchpoints.

Without a unified (and omnichannel) approach to customer feedback, executives risk making decisions in the dark, while employees struggle to engage customers at every touchpoint within the customer journey.

In this guide, we’ll explore:

Let’s dive in!

An omnichannel approach, using the channels outlined below, enables banks, credit unions, investment firms, and insurance providers to enhance customer relationships, optimize services, and address client needs effectively.

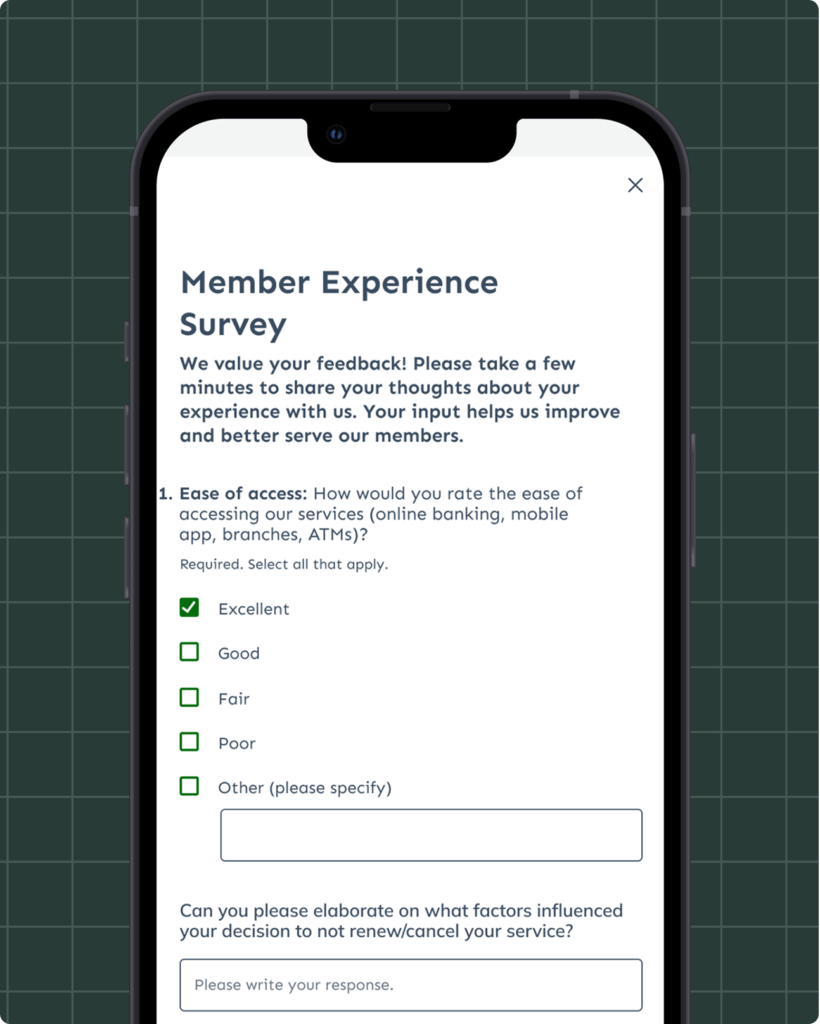

In-app feedback is essential for financial services firms, capturing customer sentiment in real time and enabling rapid improvements to mobile banking apps. Given the growing reliance on digital banking, immediate feedback loops help identify security concerns, usability issues, and feature requests that improve the overall banking experience.

Embedded feedback tools on websites are essential for tech companies to continuously refine their user interfaces and overall user experience. Feedback gathered on websites helps identify pain points in the customer journey, leading to improved conversion rates and customer satisfaction.

AI-powered chatbots and secure message centers provide instant support while collecting valuable data on customer concerns, frequently asked questions, and emerging trends. For financial institutions, this information is crucial in enhancing personalized financial guidance, fraud prevention, and improving overall customer support strategies.

Social media platforms and review sites offer unfiltered, organic feedback that helps institutions understand public perception and customer sentiment. This feedback is critical in reputation management, identifying service gaps, and responding proactively to client concerns.

For financial service providers with mobile banking apps, app store reviews provide real-time insights into user satisfaction, security concerns, and technical issues. Since these reviews directly impact app credibility and adoption, financial institutions must actively monitor and address user feedback to maintain trust and competitiveness.

Business listings and local search platforms are an increasingly important feedback channel for banks, credit unions, and insurance providers with physical branch locations. Customers frequently check reviews, ratings, photos, and questions on platforms like Google Business Profile and Apple Maps—often before or after a branch visit. This feedback influences trust, branch selection, and appointment decisions, making it essential for financial institutions to actively monitor, respond to, and analyze listings feedback as part of a broader omnichannel strategy.

The following scenarios highlight how banks and credit unions collect feedback to solve business challenges. With feedback, banks and credit unions:

Example Scenario 1

Imagine a rapidly expanding credit union. With new branches opening and digital banking services growing, the member experience team faces a challenge: How can they ensure a consistent and high-quality experience for members across all touchpoints?

The credit union’s existing feedback system is fragmented. Some branches manually collect member surveys, while digital interactions rarely generate actionable insights. As a result:

Without a consistent feedback strategy across branch locations, the credit risks missing critical issues that could impact retention and overall satisfaction.

Enter Alchemer. By integrating a real-time, automated member feedback program, the credit union gains deeper insights into member sentiment and proactively resolves issues before they escalate.

The member feedback captured drives better engagement and improves the overall customer experience.

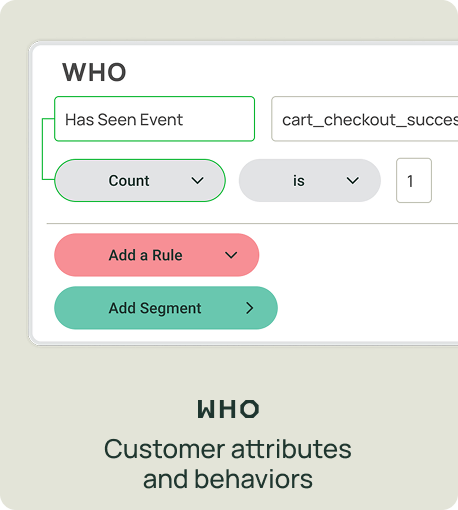

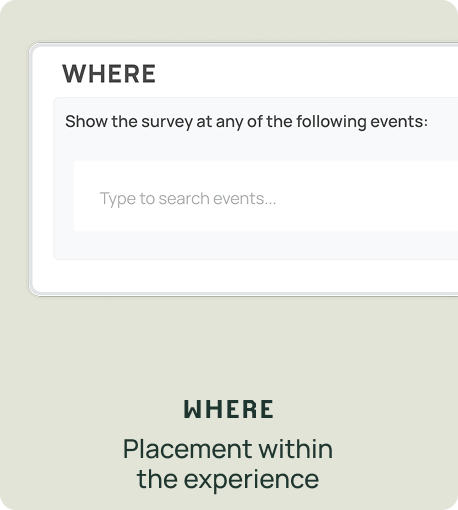

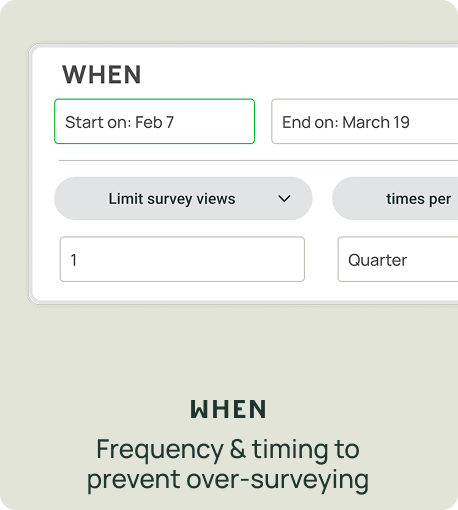

Alchemer provides powerful yet intuitive targeting features to ensure surveys and interactions reach the right customers at the right time and place.

Targeting is broken into three key areas:

Example Scenario 2

A regional bank is looking to expand into new markets and enhance its product offerings. However, the bank lacks a structured approach to collecting and analyzing customer insights, making it difficult to:

With expansion plans underway, the bank realizes it needs a more data-driven approach to market research to inform product development and growth strategies.

The bank uses Alchemer to gather market intelligence and customer insights, using those insights to make better-informed decisions across branches.

By using customer-driven research, the bank gains the clarity needed to make strategic decisions about new products, market expansion, and competitive positioning.

Seamless, data-driven banking experiences are no longer just a goal, they’re actively transforming how financial institutions engage their customers every day. This is evident in the following success stories, where industry leaders like Alkami and NCB Jamaica leveraged real-time feedback to optimize mobile experiences, boost engagement, and drive measurable business outcomes.

Alkami, a leading provider of cloud-based digital banking solutions, helps financial institutions across the U.S. create seamless and engaging mobile experiences for their members. As mobile banking adoption continues to rise, Alkami sought a better way to gather customer insights, optimize in-app experiences, and drive higher engagement.

To address this challenge, Alkami turned to Alchemer to help its clients, like Advantis Credit Union, capture real-time customer sentiment and make data-driven product decisions. Outcomes included:

National Commercial Bank Jamaica Limited (NCB) is redefining digital banking by enhancing customer engagement and communication within its mobile app. As the largest financial institution in Jamaica, NCB needed a secure and scalable solution to improve user interactions, collect valuable feedback, and drive app adoption.

To achieve this, they turned to Alchemer, leveraging in-app insights to refine their customer experience strategy and drive measurable results. Outcomes include:

Choosing the right customer feedback platform is a pivotal decision that will shape how your financial institution understands and responds to your members and clients. Purchasing a CX platform involves careful research, asking the right questions, and making an informed choice.

To get the most value from your investment, here are the key elements to consider:

The ease of implementation and use significantly impacts the success of a new CX platform. Financial institutions should evaluate how straightforward it is to set up and integrate the platform.

Look for user-friendly interfaces, clear documentation, and accessible support services. A seamless implementation process reduces downtime, minimizes disruption, and allows teams to start getting value out of the platform’s capabilities quickly.

Relying on disconnected tools not only creates blind spots in the customer journey but also leads to inefficiencies and higher operational costs. Instead of using one platform for mobile banking feedback and another for post-call surveys, wouldn’t it make sense to centralize all customer insights in one place?

A single, comprehensive feedback platform streamlines operations, enhances decision-making, and reduces costs by eliminating redundant systems—helping you deliver a better, more responsive customer experience.

Data security is paramount in financial services, where institutions handle highly sensitive customer information, including personal details, account numbers, and transaction data. To safeguard this critical information, choose a platform with advanced encryption, secure access controls, and compliance with industry regulations such as PCI DSS (Payment Card Industry Data Security Standard) and GLBA (Gramm-Leach-Bliley Act).

Strong security measures help maintain regulatory compliance and also strengthen customer trust, while reducing the risk of costly data breaches.

From mobile banking apps and online surveys to social media and chatbots, every touchpoint offers an opportunity to listen, learn, and act on customer insights. Without a comprehensive feedback system, banks, credit unions, and financial firms risk missing critical trends that impact customer satisfaction, loyalty, and long-term success.

Choosing the right CX platform is key. A solution like Alchemer enables financial institutions to capture, analyze, and act on feedback in real time, helping teams make the right decisions that enhance customer trust and business performance.

Alchemer has decades of experience helping brands turn feedback into action.

For today’s financial services firms, understanding your customers’ needs requires a seamless, multi-channel approach.

Introduction – choosing the right feedback Platform for your business When shopping for a customer experience (CX) or customer...

I had an interesting experience the other day with a customer service...

Please provide your name and email to continue reading.