Customer lifecycle management is a well-established process, but the recognition of the “relationship” component beginning at the first interaction a person has with a business is still difficult to grasp. Long before a person becomes a customer, they’re already deep into their relationship with your business. They’ve formed ideas around what to expect from your product, how you’ll communicate with them along the way, and how your experience makes them feel.

So how do you get in front of that first touchpoint to deliver a better, more customer-centric experience with your brand? Enter the phrase “customer lifecycle marketing.”

How is mobile different?

Mobile requires an entirely new set of rules and best practices to help shape a strong customer lifecycle. Mobile experiences include channels and opportunities that don’t exist in the desktop world, so there are different engagement opportunities to consider when working with mobile customers.

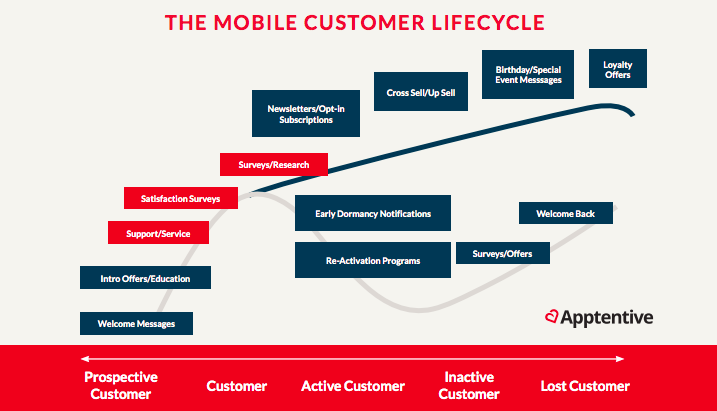

To start, let’s look at the mobile customer lifecycle below.

The mobile customer lifecycle has many of the same characteristics as traditional customer lifecycles, with one big difference: the engagement points for customer-centric outreach. Where traditional desktop experiences offer a limited number of customer engagement opportunities, the mobile device opens the door for personalized, non-intrusive outreach in a way desktop is unable to provide.

The amount of data gathered from mobile customers allows marketers to take a more personal approach to their strategies, which in turn opens doors throughout the customer’s lifecycle for proactive, contextually relevant engagement that provides a better overall customer experience.

You can use mobile customer lifecycle marketing to:

- Track lifetime customer value

- Improve your mobile customer journey

- Understand how different channels influence customer segments

- Drive engagement and monetization

- Improve app ratings and reviews

- Identify fans and detractors

- Learn where to allocate your resources

- Gather more feedback from mobile customers

- Build a better product based on customer feedback

- Select better tools for your strategy

- Improve your product and marketing messaging

Understand and measure lifetime value (LTV)

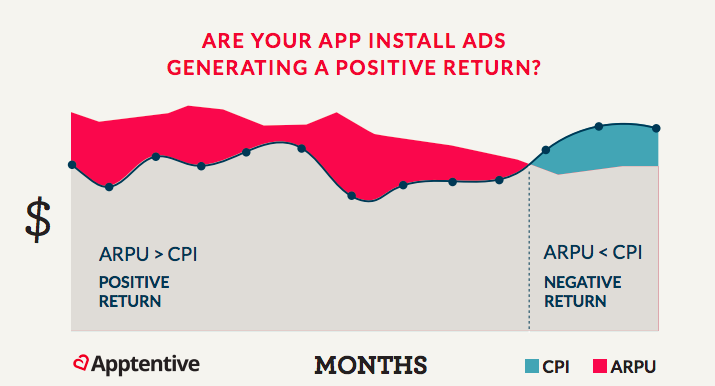

Does a low cost per install (CPI) mean you should pour all your marketing dollars into paid acquisition? Does a high average revenue per user (ARPU) mean your app’s sitting pretty in the black? The answer to either question is an unequivocal no.

When evaluating the health of their mobile apps, many marketers automatically turn toward ARPU and CPI. But while it may be common practice, relying on these two metrics alone provides just one side of the picture. What’s missing is a holistic understanding of the customer.

This understanding boils down to a single metric, known in the world as Customer Lifetime Value (CLTV, or just LTV). Lifetime value is a simple yet powerful heuristic for assigning a dollar value to both the tangible and intangible value a customer contributes to the health of your mobile app over the duration of their time with your app (‘lifetime’).

The tangible comes down to what we already know: Average Revenue Per User and Cost Per Install. The intangible dives deep within the customer journey to extend the definition of value beyond its monetary connotation. Factoring in the intangibles of customer loyalty, satisfaction, engagement, and retention, LTV provides a truer assessment of how much a customer relationship is worth to your app.

Why is an understanding of lifetime value important?

The distinction between apps that sell for millions and apps that never see a dime can often be narrowed down to a single point: How well their developers and marketers handle customer lifecycle management and understand the value of a customer.

A clear understanding of this robust metric can serve many purposes. It’s an indicator of your app’s success, a reminder of the sheer power of customer loyalty, and a tool for forecasting growth. But at its simplest, customer lifetime value is what drives your mobile marketing budget. It tells you not only how much each new customer is worth, but also how much you can pay to acquire that customer.

However, not all customers are created equal. In this chapter, we describe and calculate customer lifetime value as a predictive metric: the present value of the sum of future cash flows for the average customer. Of course, we all know that customers can’t be averaged out. Each customer interacts with your app differently and provides a different level of value, monetary or not.

Knowing the predicted, or average, LTV has several important use cases, described at the end of this guide, but serves a very different purpose from actualized LTV. Actualized LTV data is unique to the behavior of each and every customer and requires more sophisticated customer journey mapping and cohort analysis tools.

This metric allows you to better prioritize your roadmap to retain and reward your most valuable customers while targeting your acquisition campaigns based on the attributes of your high value customers.

The 3 drivers of customer lifetime value

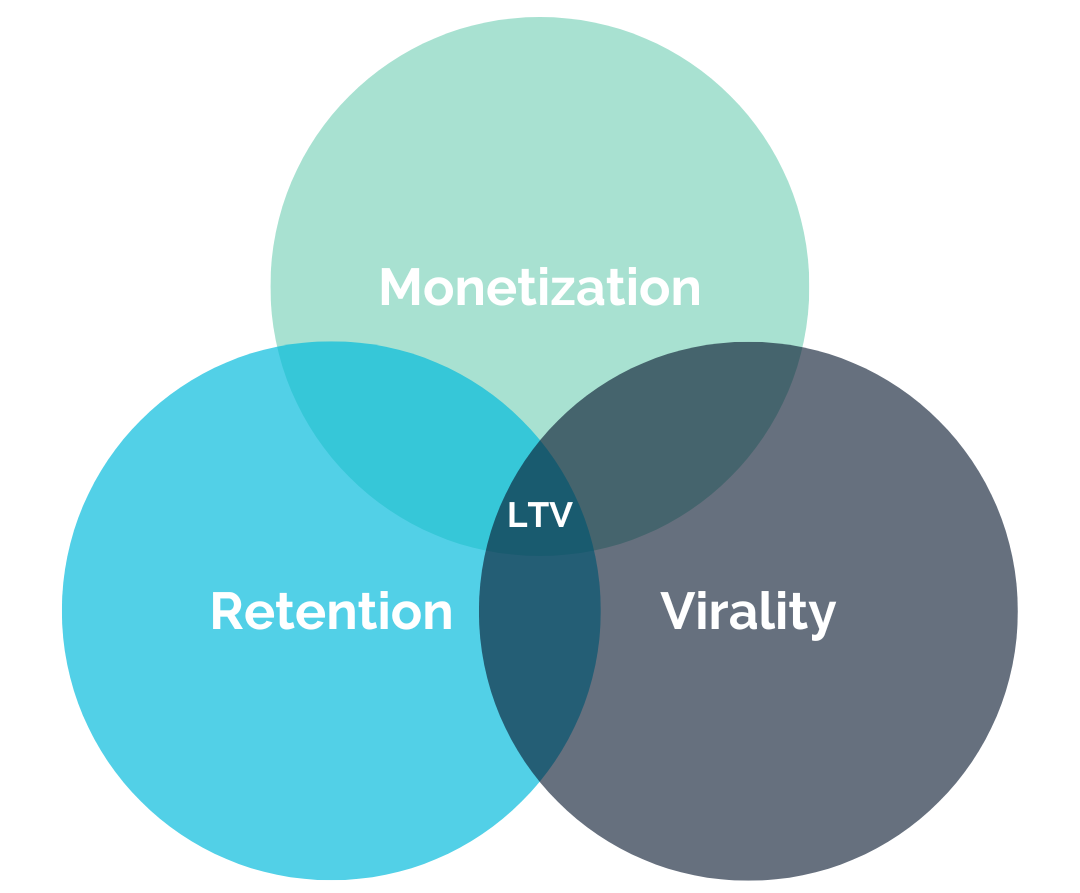

Customer lifetime value can be broken down into three categories of variables:

- Monetization: The monetary contribution each customer provides to your mobile revenue (in the form of ad impressions/clicks, user-generated content, subscriptions, in-app transactions, or whatever drives your business).

- Retention: The level of engagement and loyalty a customer exhibits with your app, looking particularly at the length of the average customer lifecycle.

- Virality: The sum monetary value of additional downloads a customer will refer to your app.

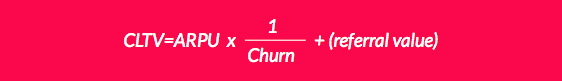

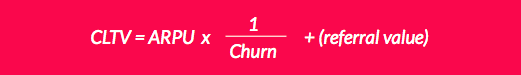

While there are several different ways of further breaking down these variables (and indeed, each business defines Monetization, Retention, and Virality differently), we recommend using the following model as a starting point for turning these variables into a concrete formula:

Of course, adding more variables to a formula doesn’t make it any simpler to comprehend, but rest assured we’ll deconstruct each component throughout the remainder of this guide. For now, note that monetization is represented by ARPU (average revenue per user), retention is represented by the inverse of your churn rate (used as a proxy for the predicted amount of time a customer will be actively engaged with your app), and Virality is represented by the sum referral value of a customer.

Also note that the Virality element is left in parentheses as an optional part of the equation as (a) few mobile app marketers have the means of tracking this information, and (b) its calculation can get a little messy.

1. Measuring monetization

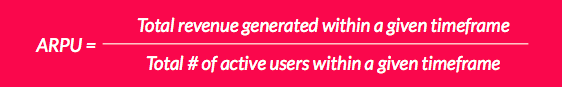

The first step to calculating mobile customer LTV is to figure out how much revenue the average customer generates in a given timeframe. This figure is commonly denoted as average revenue per user, or ARPU.

You can find ARPU by dividing the sum amount of your mobile revenue generated in a specific time period by the number of customers that actively engaged with your app in that period:

ARPU is typically reported on a per-month basis. Some marketers, however, have taken to reporting it on a per-week or per-day basis, given that the average app only retains 25% of its customers for a period greater than one month.

The definition of an ‘active’ customer is also open to interpretation as many marketers segment their customers in order to perform a more meaningful analysis. For example, some might opt to raise the bar on engagement and retention by only looking at daily active users, or filter out unpaid users in the case of a freemium app by only looking at paying users.

For the sake of comparing LTV to the cost of customer acquisition, we suggest being a little looser with your retention and engagement criteria and consider all customers who launch your app within your designated time frame—ideally, your monthly active users (MAUs).

2. Measuring retention

The next step in calculating customer LTV is to predict the lifespan of an average customer: How long are customers retained, or engaged, with your app?

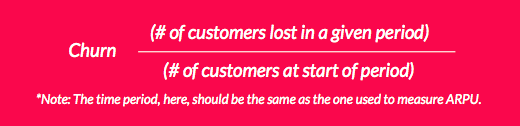

To measure this number, you need to first know your churn rate: What percent of customers stop using your app within your given timeframe? You can calculate churn by dividing the number of lost customers in that time period by the total number of customers going into that period:

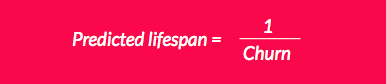

Once you have calculated churn, you can take its inverse (1/churn) to find the predicted amount of time a customer will spend engaged with your app. Using the same units as your time period, a monthly churn rate of 50% means that the predicted lifespan of a customer is two months.

3. Measuring virality

While Revenue and Retention are fairly straightforward, measuring Virality demands more intricate analytics and referral programs that must be built into the core framework of an individual app. Without this attribution data, Virality is next to impossible to accurately measure. More often than not, it’s removed from the LTV equation altogether due to its inherent difficulty and ambiguity.

For marketers that do have access to these data points, the Virality part of our equation identifies the average number of referrals a customer brings in and then multiplies it by the individual revenue contribution [ARPU x (1/Churn)] of an average customer.

For the rest of us, Virality is something that should be in the back of our minds, but not a necessary part of the equation.

Piecing it all together

Once you’ve calculated ARPU and churn, you’re ready to calculate predicted customer lifetime value. Now, it’s just a matter of bringing it all back together.

Practice time: How much is a customer relationship worth?

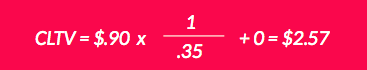

Let’s say your average user generates $0.90 in revenue every month, and you have a monthly churn rate of 35%. Your customers are, no doubt, evangelizing your app in the form of ratings, reviews, and word-of-mouth, but without an accurate calculation, let’s simply set referral value to 0.

Plug in the numbers, and your formula now looks like this:

That means your average customer has a predicted lifetime value of $2.57, not accounting for the value of referrals.

Using customer lifetime value

Returning to the method behind the madness and why we first embarked on this journey into the math of the customer, you are now able to use your newfound data in several meaningful ways to turn to your app into a business.

Perhaps most importantly, you now have all the tools in place for deciphering whether or not it makes sense to invest in app install ads and other customer acquisition campaigns.

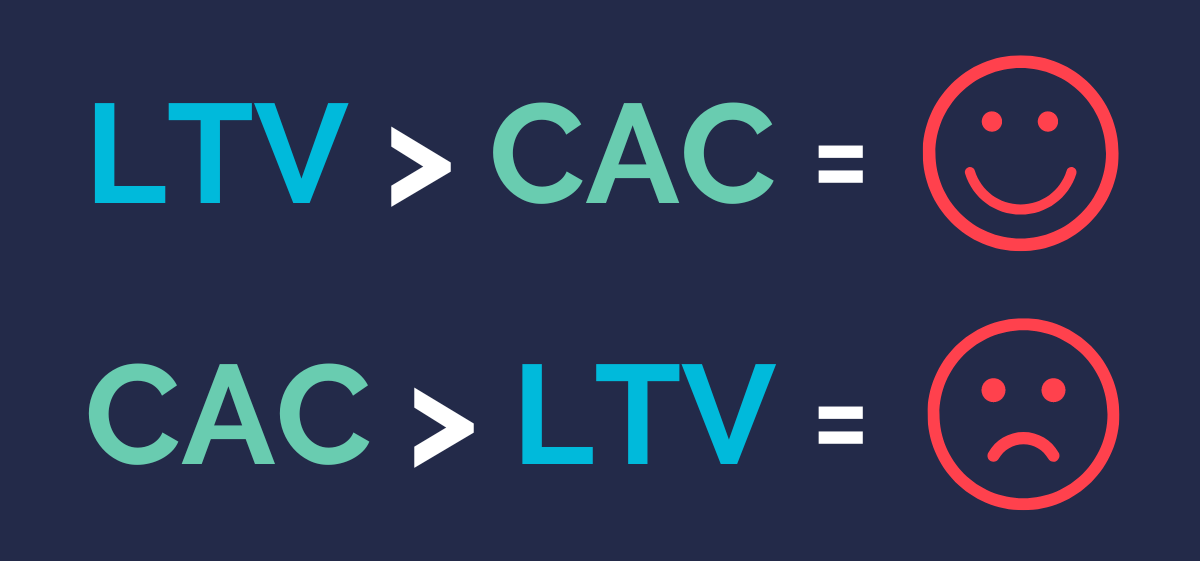

As long as the average customer lifetime value (LTV) exceeds the customer acquisition cost (CAC), your marketing expenditures will have a positive return on investment. The rule, then, becomes continue to invest in marketing if and only if your returns are positive.

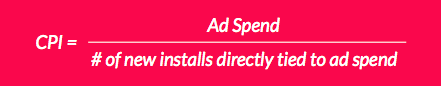

In the world of mobile apps, customer acquisition almost always comes down to the cost per install (CPI). This is calculated by dividing the amount spent on advertising by the number of new customers attributed to that specific campaign:

If it costs less to acquire one customer (one install) than the amount of revenue that customer will likely generate, then advertise away. If not (as is often the case in a surprising number of app categories), you’ll need to first find a way to boost retention, increase ARPU, or grow referrals to rebalance the equation before it makes economic sense to invest in app install ads.

Conclusion

Ready to see Alchemer in action? Talk to a salesperson today!

Not quite ready yet? That’s ok too! Here are some additional resources to check out:

- Alchemer Digital: Learn how Alchemer Digital drives omni-channel customer engagement across digital properties.

- Customer Stories: See how organizations have used Alchemer to elevate their customer feedback programs and do more with feedback.

- Customer Feedback in the Digital Era: Read our e-guide on the importance of customer feedback amid Digital Transformation.