In today’s competitive landscape, customer experience (CX) stands as a cornerstone of success, particularly in the financial services industry. Implementing a robust CX Program in Financial Services is crucial, as it has never been easier for customers to switch banks, wealth and investment managers, or financial technologies. What used to require an in-person visit or multiple phone calls can now all be done online and quickly.

Reduced switching costs are pushing financial institutions to think critically about how they engage and serve their customers. 40% of banking customers are willing to leave their provider for a better digital experience alone! A strong CX program, especially on digital platforms, has become a competitive necessity. Effective CX acts as a key driver of customer loyalty and boosts profitability through retention and referrals.

A great CX program isn’t as daunting as it sounds. Yes, it takes company-wide buy-in, but at the end of the day creating good customer experiences boils down to two fundamental concepts:

- Listening to the voice of your customers and collecting their feedback: Understanding what customers want and how they perceive your institution is foundational. Whether through surveys, online reviews, or direct interactions, gathering actionable feedback provides invaluable insights into areas for improvement.

- Taking the right actions based on customer feedback: It’s not enough to collect feedback; financial institutions must act on it. Implementing changes based on customer input demonstrates a commitment to improving their experience while addressing customer challenges.

In this blog, we will return to those two fundamental concepts time and time again as we dive into the critical steps necessary to create strong customer experiences in the financial services industry.

Step-by-step guide to building a strong CX program

Step 1: Assess Current Customer Experience

Banking customers now expect interactions with financial institutions to be personalized, fast, and convenient. These interactions could be in the form of a banking app, on a website, or just through a simple survey.

The first step to meeting these expectations is assessing your current experience. Identifying where there are gaps, what customers want to see more of, and what you are doing well.

And how do you start to better understand how your customers are feeling? You ask. And listen!

However, not all companies are great at asking. Within financial services companies, only 62% of feedback of the feedback collected is solicited, which is significantly lower than the Tech (78%), Healthcare (74%), and Retail (73%) industries.

Thankfully, the quantity, power, and diversity of feedback collection tools is greater than ever:

1. Collect Digital Feedback (In-App and Web)

Digital feedback allows you to better understand the performance and experience of your banking app or website. Many leaders in the financial services industry recognize the need to improve their digital experiences, with 54% of execs listing digital experience as a priority in 2024.

Requesting feedback through these channels in the moment allows you to gather relevant insights from specific customers. This helps you understand their needs before they turn to one of your competitors. Proactively gathering feedback helps you quickly identify and address customer pain points. This approach prevents these issues from escalating into wider problems, such as churn or negative reviews.

Digital feedback also helps you acquire insights into overall customer experience and larger brand perception. Customers often use in-app feedback channels to share their thoughts on more than just the app. For example, they might provide feedback on their in-person experience, such as when they tried to deposit a check.

This deeper understanding helps you connect the dots between various points of contact along the customer journey. As a result, you can provide a more seamless and cohesive customer experience.

2. Monitor Ratings and Reviews

Ratings and reviews are key metrics you can use to measure customer experience. High ratings on App Stores, G2, and other review sites are all important, especially when it comes to customer acquisition.

A strong reputation on review sites is a massive competitive advantage over other banks or financial institutions.

If your ratings drop or you are getting unfavorable reviews, do your best to respond to the issue and solve them immediately. The earlier you fix the problem and communicate the solution to customers, the better your relationship can become.

3. Traditional Surveys

There is a reason why surveys are so popular: Companies can quickly collect and analyze both quantitative and qualitative feedback from customers. Surveys are also powerful in understanding customer sentiment. With precise targeting capabilities, these surveys reach customers at the core of their experience. They offer valuable insights into their sentiments, preferences, and satisfaction levels.

4. Collect Customer Sentiment Data

Tracking customer sentiment helps you understand various aspects of customer feedback. Among other things, it reveals overall satisfaction with the quality of your product or customer experience.

Gaining insight into customer sentiment can be a winning strategy for your marketing, product, and CX. The more you understand a customer’s current emotional state, the better you can tailor your products and campaigns. This approach helps provide an engaging and helpful experience.

What does collecting sentiment data look like in practice?

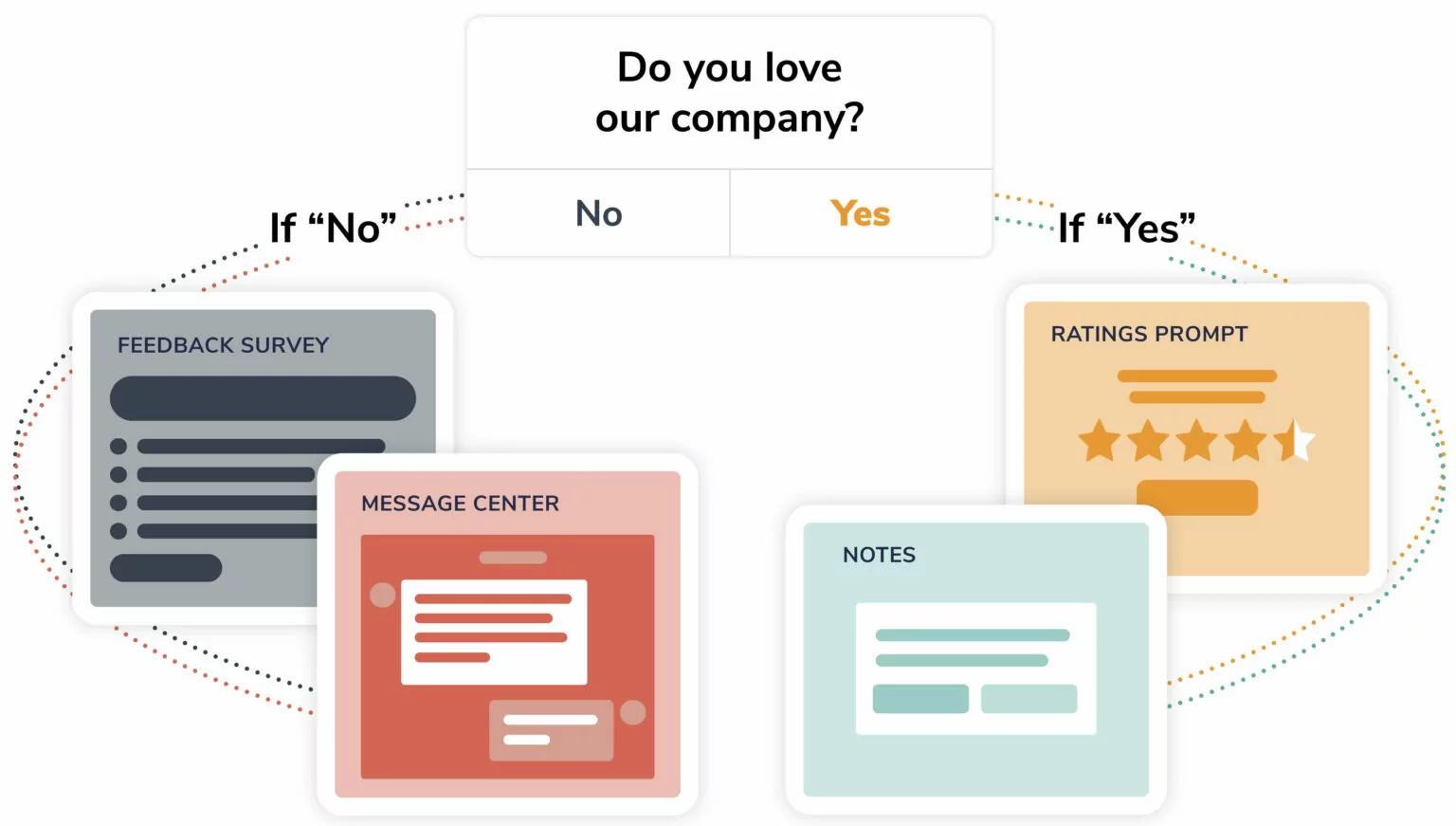

At Alchemer, we recommend that our customers, with a mobile app, regularly prompt their customers with a simple Yes/No question asking, “do you love our company?”. This simple question lets you easily identify and retarget your happiest customers or customers at risk.

Step 2: Identity Key Areas for Improvements and Develop an Action Plan

After collecting feedback on your current customer experience, identify trends or areas for improvement. Then, develop a plan for acting on the feedback.

Utilize AI-Driven Text Analytics: The right AI tool can identify trends and sentiment patterns in your customer feedback. It provides actionable insights that guide decision-making and targeted improvements. AI tools vary in their design and capabilities. Ensure you select one that is specifically built for customer experience (CX) and feedback.

Prioritize the Right Items on Your Product Roadmap: Use the insights from the collected feedback to guide your CX improvements. Prioritize these improvements on your Product Roadmap. Next, assess the potential impact and feasibility of CX improvements. Focus on initiatives that align with both customer expectations and business objectives.

Set SMART Goals: Define Specific, Measurable, Achievable, Relevant, and Time-bound (SMART) objectives for each improvement initiative. Clear goals facilitate alignment across teams and enable effective measurement of progress.

By taking the right, feedback-informed actions, financial institutions can build a CX program that enhances customer satisfaction. This approach also drives growth in a competitive market.

Step 3: Foster a Culture of Customer Obsession

Feedback isn’t meant to live in a vacuum. From customer support to UI/UX to sales, make sure teams are equipped with the CX insights you uncover. What does that look like?

Make Feedback Accessible: Regularly share insights and feedback with relevant teams. This often requires integrating feedback into your key business systems like CRMs, marketing automation platforms, or communications tools. For customer-facing employees, enable them to act on feedback promptly, fostering a responsive and proactive approach to CX.

Use Customer Insights to Improve Employee Training: Incorporate customer feedback into training programs for staff across all departments. Equip employees with the skills and knowledge needed to deliver exceptional customer service and address customer needs effectively.

Empower Teams with CX Insights: Integrate CX metrics and insights into performance evaluations and departmental goals. Encourage collaboration across teams to collectively drive improvements in customer experience.

Security Tip: Make sure to remove any PII (Personally identifiable information) from the data and insights you share!

Step 4: Implement CX Improvements and Close the Loop

As you roll out CX improvements, close the loop with customers and let them know their voice was heard. If a customer identifies a bug in your banking app or mentions experience issues on the website, acknowledge their feedback. Let them know that you have taken action to address the issues. Workflow and automation tools streamline this process and make closing the loop scalable, timely, and personalized.

Step 5: Monitor and Measure Success

As CX improvements are made, define Key Performance Indicators (KPIs) to track progress and measure the effectiveness of CX initiatives. In today’s budget-conscious business world, tracking CX metrics is critical to proving the value of customer experience on the business.

Tools and Resources

To effectively gather and utilize customer feedback, financial institutions need robust tools. These tools should support omnichannel engagement, integrate with existing systems, and prioritize security. Here are the key features to consider when choosing a feedback solution:

- Omnichannel Capability: Ensure the tool can collect feedback through various channels such as in-app, on a website, or just through email surveys. This allows for comprehensive data collection across different touchpoints in the customer journey.

- Integration with Existing Systems: Choose a tool that seamlessly integrates with your CRM, analytics platforms, and other operational systems.

- Security: Protect customer feedback and personal information with robust security measures. Look for tools that adhere to industry standards and regulations to maintain customer trust and compliance.

- Analytics and Reporting: Opt for tools that provide advanced analytics capabilities, including sentiment analysis and trend identification. These insights help prioritize improvements and gauge customer sentiment effectively.

Conclusion

In today’s financial services landscape, digital convenience has heightened customer expectations. As a result, a strong customer experience (CX) program is not just a competitive advantage but a necessity.

Building a robust CX program begins with listening to customer feedback and acting on it effectively. By harnessing insights from a variety of feedback channels, institutions can pinpoint areas for improvement and deliver personalized experiences that resonate with their customers.

If you are interested in elevating your CX program, Alchemer would love to help. Ready to see our feedback solution in action? Request a demo.

If you aren’t quite ready yet, here are a few resources to learn more about Alchemer:

- Customer Stories – See how our customers have used Alchemer to elevate their CX and feedback programs.

- Alchemer Pulse – Learn how our AI text analytics solution uncovers hidden customer insights and transforms those insights into business impact.

- Integrations – Check out Alchemer’s dozens of prebuilt integrations. If you don’t see an integration that you need, don’t sweat it! Our low-code design and architecture allow teams to seamlessly connect Alchemer to almost any platform using our API.