Have you ever been turned down for a job you spent weeks interviewing for? Or maybe you thought you had a fantastic first date, only to get no response to your follow up texts and emails?

Any time we put forth a lot of effort and fall short, it’s natural to ask why. The sales process is no different.

Fortunately, there’s a formalized process – the win-loss analysis – that can give insight into the “why” behind a won or lost sale. Although often conducted in the form of telephone or in-person interviews, you can streamline this process (and identify its actionable data) far more easily by using online surveys.

A Brief Definition of Win-Loss Analysis

Ideally conducted within three months of a sale, a win-loss analysis is simply the process of contacting clients following the conclusion of a sales activity. The goal is to find out what your company did right (and wrong), how you can improve, and where you stand in relation to the competition.

Salespeople are understandably close to their clients and prospects, so they tend to be poorly suited to undertaking a win-loss analysis on their own.

Instead, using the competitive intelligence group, marketing team, or an outside consulting firm will give you the most accurate win-loss data.

7 Steps to a Solid Win-Loss Analysis

From picking the right accounts to conducting the interview and all the way through disseminating the results, Ellen D. Naylor does a great job of outlining the full process of conducting a truly useful win-loss analysis.

Step 1: Target the Right Accounts

Naylor suggests starting with, “strategic accounts that generate most of your company’s revenue,” but there may be management pressure to investigate surprise wins or losses in a certain industry or segment.

You can even start the process off on a data-driven foot by distributing a survey to all interested parties and choosing the accounts that most respondents identify as important.

Step 2: Include the Win-Loss Survey Team in the Sales Process

The nature of their work makes sales more likely to keep detailed information on won accounts than those that they lose, but the CI or marketing team who will be conducting the win-loss analysis needs all the data they can get.

By embedding these survey creators in the sales process, you’ll get a more complete data set that can inform future win-loss questions.

Step 3: Create Your Win-Loss Survey

We’ll cover this in more detail in the following section, but most win-loss analysis questionnaires cover the same core areas: sales attributes, company reputation, product attributes, and service issues.

Make sure you have sections for both your company and your competitors; you’ll need to collect the same data about both groups to create accurate comparisons.

Step 4: Win or Loss Occurs

The interviewer needs to understand the exact circumstances of each sale, whether that results in a win or loss.

A thorough knowledge of the particularities of each transaction will allow interviewers to customize questions and follow up with qualitative questions that have the best chance of uncovering root causes.

Step 5: Conduct Interviews

The most common form of a win-loss analysis is via telephone interview; this format allows for in-depth discussion and follow-up questions based on actual responses. High value accounts, however, may warrant an in-person visit.

If your business deals in a high volume of sales, or you find yourself short on interviewers and/or budget, online surveys can significantly reduce the time required to conduct these interviews (more on this shortly).

Step 6: Tally Results and Analyze Data

Keep in mind that the ultimate goal of conducting a win-loss analysis is to earn more business. Each survey question you ask should be directed toward this goal and this goal only.

Naylor gives these examples of potential insights that teams can pull from effective data analysis:

“[T]he analysis may find out that your company loses in 90% of cases against competitor X, so Sales may elect to walk from those ‘opportunities’ unless your company is well positioned with the client. In other cases, win-loss analysis can identify specific tactics Sales should use when competing against a specific competitor, based on that competitor’s weaknesses.”

Step 7: Disseminate Results as Needed

It’s likely that at least some of what you uncover during your win-loss interviews and analysis will impact other departments. Consider who might benefit from a knowledge share, and format your report accordingly.

On the other hand, don’t feel obligated to share each and every insight; otherwise, you might create information overload in your audience.

Always Ask These 4 Types of Questions During Win-Loss Analysis

Each win-loss analysis should be a customized process that’s based on your organization and its products, but the survey questions nearly always fall into these four types:

Sales Attributes

While this section should cover the professionalism of the sales person conducting the transaction, it can also cover levels of trust between the client and your organization, how your company is positioned among competitors, and a client’s feelings about how your product has been marketed.

Company Reputation

This section moves beyond sales and marketing perceptions and into the way prospects think about your organization as a whole.

Do people tend to see you as more professional or stable than the competition? Is your product seen as more reliable over time? Where does your support offering fall on the competitive scale?

Product Attributes

Of all four sections, this one covers the broadest territory. You’ll want to ask about your product or service’s specific functionality and features in comparison to others on the market, paying particular attention to whether or not the product works as promoted.

You’ll also want to investigate your technology offerings in relation to competitors.

Finally, when looking into price, try to uncover exactly what’s included in your competitor’s price in relation to yours. Price is often cited as a reason for a loss, but it may be only a contributing factor rather than the primary cause.

Service Issues

For both wins and losses, find out if the delivery and implementation process went smoothly, or if the associated costs went over budget or outside of scope.

This is also a good opportunity to find out about any service level agreements, maintenance, or training programs that your competition is offering.

Why Survey Tools Produce the Best Win-Loss Data

I’ve mentioned that many win-loss analyses take place as phone interviews, but that doesn’t mean they aren’t a good fit for survey tools.

By having interviewers input their data into an online survey or questionnaire, you gain the benefits of sophisticated data analysis, longitudinal views of trends, and a central source for all your win-loss information.

You can also streamline the win-loss data collection process by distributing a survey electronically in advance, and then conducting the interview as a follow up. Asking ranking questions (the best method of asking win-loss questions) over the phone can be convoluted, while an online survey makes it simple for respondents to offer this data rapidly.

Depending on the complexity of your sales process and products, you might also be able to conduct a large portion of your win-loss analysis via online surveys, skipping phone or in-person interviews and reducing time spent and cost.

Even qualitative analysis of open-ended questions is more helpful when you can use software to eliminate outliers. Additionally, creating reports like word clouds help you quickly identify trends and patterns.

Best Survey Question Types for Post-Sale Interviews

Scale questions should be your go-to question type for all win-loss analysis surveys.

As Roger Allison puts it, “What a prospect declares after a decision process is steeped in emotion. As a result, it is easier to secure a scale of how they feel about a subject than it’s to secure tangible and resolute free-form articulation of a complex sales cycle.”

Remember to use only odd-numbered scales, and to offer open text follow-up questions to collect any comments that a respondent wants to add.

To minimize survey fatigue, you may want to consider limiting your scales to five options, and definitely no more than seven.

Win-Loss Analysis Surveys for Sales Success

Conducting a formal, consistent win-loss analysis can be challenging, but incorporating online surveys into the process can save you significant time and money.

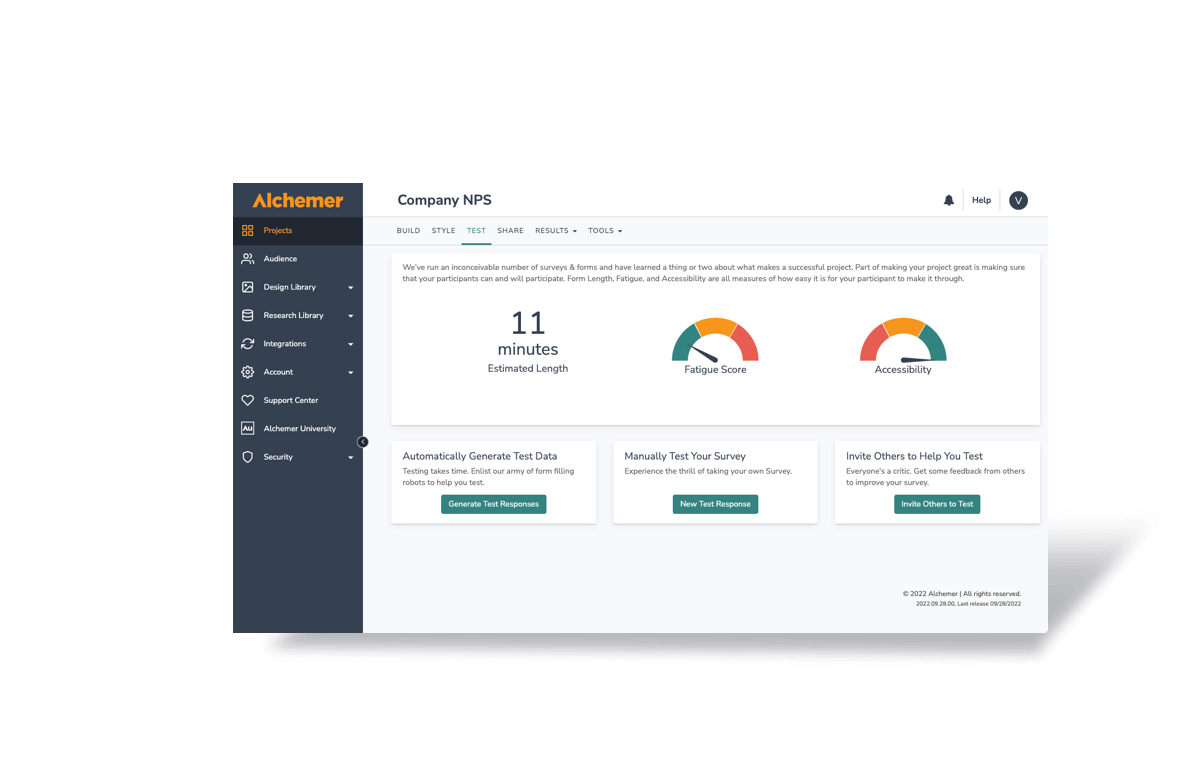

Simple scale questions with open text options will help you collect the data you need to consistently improve your sales process. And, with Alchemer’s Team Edition, you can invite your marketing, competitive intelligence, and sales team to the same project for easy insight sharing.

Andrea Fryrear is the chief content officer for Fox Content, where she uses agile content marketing principles to drive content strategy and implementation for her clients. She also writes for and edits The Agile Marketer, a community of marketers on the front lines of the agile marketing transformation. She geeks out on all things agile and content on LinkedIn and Twitter.