Collecting meaningful data via student surveys doesn’t mean a simple one-time survey during their orientation.

To get an accurate and actionable look at their academic careers you need to start collecting their responses before they arrive on campus and continue after they’ve graduated.

Each touchpoint offers its own unique opportunities and challenges, but focusing on each one in its own right can deliver a holistic overview of student life, institutional perceptions, and alumni results.institutional brand awareness

We’ll walk through three key times to leverage student surveys:

- Before their arrival on campus: getting insight into what students are like prior to a college experience and tracking sentiment about your university’s brand.

- During their academic career: Enrolled Student Surveys (ESS), faculty feedback, and beyond.

- Post-graduation: using longitudinal studies to track professional success and opinions about their college career.

Using Student Surveys to Collect Pre-College Data Prior to Arrival on Campus

There are two types of student populations that need to be surveyed outside your institution’s campus:

- Students who have not yet chosen to enroll with you.

- Students who have enrolled and will be arriving on campus soon.

Surveys for each group have distinct goals, and as a result they contain very different questions. We’ll cover each one separately in this section.

Student Surveys for Institutional Brand Awareness

The first group is important to track because you need to maintain an understanding of how prospective students perceive your university’s brand. Just as consumers have preconceived notions about a product without ever buying it, students have pre-existing ideas about colleges.

Small improvements in brand awareness are directly correlated with increases in brand preference, so this is something your institution needs to be aware of.

You can measure two different forms of institutional brand awareness: aided and unaided.

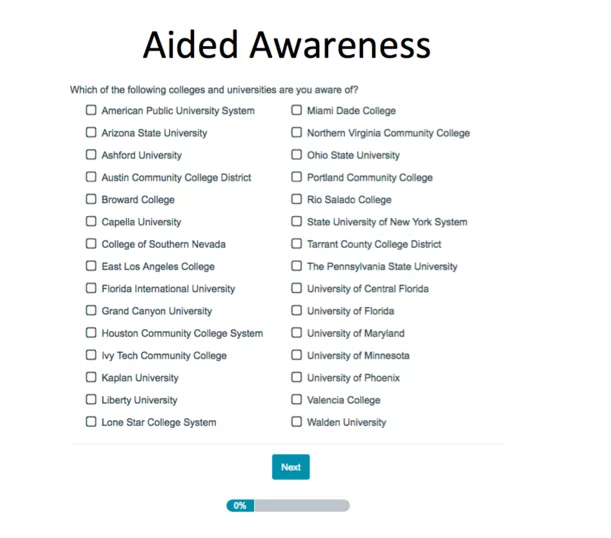

Aided brand awareness helps you understand how your university stacks up against similar institutions. These surveys offer prospective students a list of colleges and/or universities and asks them to indicate which ones they’re aware of.

An aided brand awareness survey question would look like this:

For newer institutions, or those not well established with a particular segment of their target student population, aided recall will help you gauge how you stack up against similar colleges.

These types of questions are also particularly useful if you know which other institutions you compete with most closely for enrollment. By providing a list of options from which students can choose, you’re limiting the choices and giving you more specific comparison capabilities between awareness of your college and other close competitors.

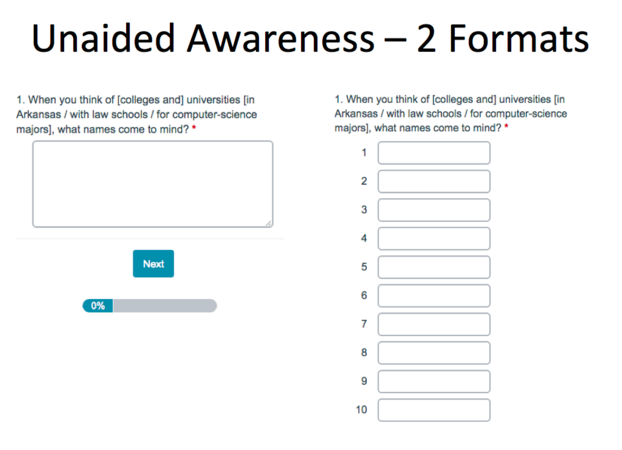

Unaided institutional brand awareness, however, requires your college or university to be so familiar to students that they can summon it with no prompting whatsoever.

These questions don’t offer any choices; instead they are blank spaces that ask students to write in institutions that they’re aware of:

You will certainly get a larger variety of responses from unaided questions, and this can make it more difficult to compare your institution to other specific competitors. However, unaided recall is more closely correlated to consumer choice. This means that if you enjoy a high level of unaided recall among your target student population you have a much better chance of getting them to enroll with you rather than with a competing institution.

Brand awareness studies need to be run regularly, at least twice per calendar year, so you can keep track of any shifts or trends.

For supplementary insight you can also try four other types of institutional brand health surveys:

- Institutional Brand Image: Measure how closely student perception of your institution’s brand matches the image that you’re trying to convey through your marketing materials.

- Institutional Brand Trust: Modern students have high expectations of the colleges they’re affiliated with, so you need to make sure they see you as worthy of their trust.

- Institutional Brand Loyalty: Alumni are a critical source of word of mouth marketing, so regularly assessing how loyal former (and current) students feel toward your university’s brand is vital.

- Student Profile Study: If your student population is changing, but the population you’re surveying to measure brand awareness is staying the same, you may end up with a disconnect between your marketing and your audience. Regular profile surveys can help.

For more on best practices for brand awareness surveys, we recommend this Definitive Guide to Doing a Brand Awareness Study, written by one of our survey experts.

Student Surveys for Freshmen Prior to Arrival

In addition to knowing how prospective students feel about your institution’s brand, you also want to establish baseline data about your incoming freshman class. This will allow you to more accurately track shifts during their college career.

Key aspects of a freshman survey include:

- Established behaviors in high school

- Academic preparedness

- Admissions decisions

- Expectations of college

- Interactions with peers and faculty

- Student values and goals

- Student demographic characteristics

- Concerns about financing college

The difficulty of administering these types of surveys is two-fold: institutional researchers must reach students who are not yet on their campuses, and they must get the best possible response rate to set them up for longitudinal study success.

Reaching Freshmen Off Campus with Student Surveys

When students arrive on your campus you know where they’re likely to be. You can reach them in high traffic areas, in their dorms, or on their college email accounts. But prior to enrollment it can be difficult to connect with students to administer a survey.

There are three relatively easy ways that you can increase your chances of reaching students pre-enrollment:

- Old Fashioned Mail: Parents of high school seniors are accustomed to receiving important communication in the mail, so you can often reach students through their parents. If you choose this route be sure to communicate the value of the student’s response in terms that will appeal to both student and parent.

- Orientation Events on Campus: Setting up a table at events that will attract large numbers of incoming students can be a great opportunity to connect with them (and it can also get them accustomed to being surveyed on campus). Small incentives can be a great way to make survey taking more appealing in these situations.

- Email and Social Media: If you can collect social media information from students during the enrollment process you can use these channels to reach out to them. Similarly, if students will receive a college email address prior to their arrival on campus you can distribute a freshman survey through this medium.

All of these suggestions may or may not work for your institution. You’ll need to be a little creative about how you connect with students who aren’t yet on campus full time.

And, of course, you also have to keep in mind that limiting your survey distribution to a single channel may introduce bias into your results by skewing the type of students who you can reach. The more ways you can send out your survey, the more students you will reach, and the more representative your data will be of the actual student population.

Student Surveys for Enrolled Students

To minimize the need to constantly survey a student population, many institutions choose to run enrolled student surveys only every four years. If time and budget allow, you may want to consider doing one every two years so that any students who graduate early will still be covered.

These student surveys are typically administered to the entire student body, with common subjects including:

- Time spent on various activities in and out of the classroom

- Perceptions about how skills and abilities have changed since enrollment

- Sources of advice about academic, career, and personal choices

Of course you’ll want to make sure to ask appropriate demographic and academic questions as part of this survey so that you can segment your responses appropriately.

Your data will be most useful if you can identify trends among sophomores majoring in psychology, for example, instead of being forced to simply look at the entire population as a whole.

Senior-Specific Student Surveys

Targeting students in their final year of study can give you unique insights into the arc of the college experience at your institution. Seniors often have very particular feelings about their education based on how successful they have been in securing employment or acceptance to graduate programs, and gathering this data can be highly informative.

Senior-specific student surveys can be administered via email and in person on your campus, and they typically investigate:

- Plans after college

- Satisfaction levels with various aspects of their college experience

- How students’ perceptions of their abilities have changed since enrollment

- Questions about financing and student debt

- Current and past involvement in cocurricular and extracurricular activities

- Opinions about teaching practices and institutional experiences

Using Student Surveys to Gather Feedback on Faculty and Courses

In order to reduce survey fatigue in the student population, it’s typically best to limit your course-related surveys to a single instance at the end of each semester.

Some institutions administer these student surveys through faculty-controlled organizations, while others gather data as a small part of larger institutional research. Whatever your situation, your faculty feedback and course evaluation surveys should be tracking:

- Specific questions about the instructor’s style and availability

- Questions focused on the course content

- Whether or not the course was too difficult or too basic

- Student’s likelihood to recommend both the course and the instructor to other students

To get additional insight into the types of students that are offering certain types of feedback, you can also ask a few questions about the student as part of this survey, such as:

- How prepared are you for class each day?

- What percentage of the assignments did you complete on time?

- Is this course part of your major?

Student feedback on courses often have some of the best response rates because you can administer them in the classroom.

Monitoring Student Health and Wellness with Student Surveys

College can be a trying time for students, and maintaining data around their mental, physical, and emotional well being should be part of your institutional survey plan.

This is particularly true since schools that have a positive school climate report better test scores and higher graduation rates.

Common areas of inquiry around student health and wellness include:

- Health insurance and utilization of health care options

- Mental health

- Use of alcohol, tobacco, and other drugs

- Financial health and security

- Nutrition and physical activity levels

- Sexual safety

These student surveys often collect sensitive data, so you should ensure that if necessary your surveys are HIPAA compliant and student information is securely stored. Communicate privacy policies and how the data will be used very clearly in the survey itself so that students will feel comfortable offering honest answers.

Student Surveys for Post-Graduates

Common time periods for surveying graduates are three and five years after graduation, but the period of time between graduation and your first survey will depend on typical student behavior. Most institutions re-administer the survey every four years.

If a large number of your graduates tend to enter graduate programs, you’ll want to administer the first post-graduation survey in the three year window to make sure you gather accurate data from this group.

Their feelings of preparedness for graduate school may change over time, and you need to create visibility for that shift with an early alumni survey.

MIT, which has a large percentage of its students go on to do advanced academic work, surveys its alumni at both the three and five year marks.

Their three year survey, also known as the, “What Are You Doing Now?” survey, “is intended to be a concise way to check in with our recent alumni and get a better idea of their career and educational trajectories after graduation and before our more comprehensive alumni surveys done 5+ years after graduation.”

Common areas of inquiry for alumni surveys include:

- Current employment

- Post-graduate education

- Estimated gains in knowledge and skills

- Level of involvement as undergraduate students

- Continuing involvement with the institution

- Student debt levels

- Overall level of satisfaction with the college experience

- Likelihood to recommend the institution to others

First Destination Surveys

In 2014 the National Association of Colleges and Employers (NACE) began collecting data from recent graduates about their immediate post-graduation outcomes.

Known as the First-Destination Survey, this assessment was administered by over 250 institutions to hundreds of thousands of students. This initiative has created standardized definitions, time frames, and parameters that allow disparate academic institutions to collect comparable data and thereby identify larger trends.

NACE offers a survey template that you can use to run the survey in the tool of your choice. The First-Destination Survey will be administered yearly; you can find out more about how to get your institution involved at www.naceweb.org.

Conducting Student Surveys Throughout College Careers

Don’t limit your institutional research involvement to a single point of contact with students. Do your best to reach them throughout their academic life cycles, and you’ll be rewarded with data that can lead to better alumni engagement, higher enrollment, and more effective fundraising.