Researchers seeking qualified survey respondents may find social media a tempting option for gathering participants.

However, our own recent research indicates that most online researchers (60%) aren’t drawing from public social networks to gather survey responses.

Who is Using Social Media Surveys?

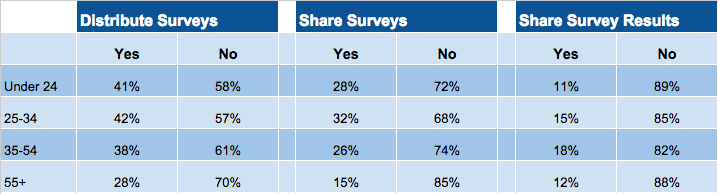

According to our survey of 866 online researchers, only 39% of market researchers are distributing social media surveys.

Of those who are conducting a survey on social media, there are some interesting trends:

- Researchers aged 25-34 are the most likely to distribute social media surveys. They’re also the most likely to encourage their respondents to share their surveys within social networks.

- Those over 55 years old were very unlikely to distribute surveys or survey results on social media.

- The under 24 age group was the most unlikely to share survey results on social media (89% said they did not do so).

Most Popular Networks for Social Media Surveys

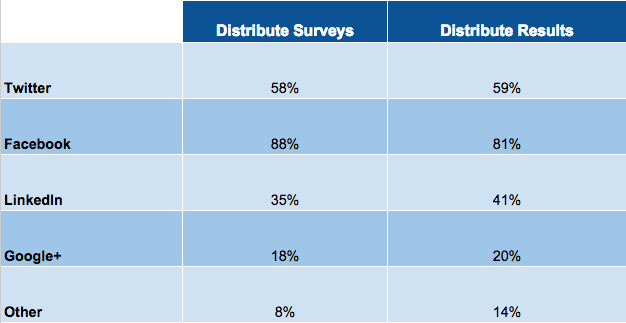

Among those utilizing social media surveys in their strategy, Facebook stands out as the most preferred platform. Researchers favor it for distributing both surveys and their results. This trend highlights Facebook’s significant role in social media survey distribution.

Twitter came in second, followed by LinkedIn:

Challenges of Distributing Social Media Surveys

As we’ve seen, the majority of researchers aren’t using social media surveys.

Some things we heard from researchers were:

“Our surveys are targeted at specific users and personas. We just can’t do that with social media.”

“Social media would ‘invite’ people who cannot participate.”

“I think my company is not prepared to handle social media marketing and the relationship with our customers in this environment.”

Researchers hesitate to mine social media for respondents due to the expectation of reciprocity in sharing results with participants. They feel that if they collect data via social media they’ll be expected to share results there as well.

For some studies it’s not a problem to make results public, while for others the data is proprietary.

Overcoming Limitations for Social Media Survey Data Collection

In some ways social media is the ultimate qualitative research tool. The challenge lies in effectively utilizing social media for research purposes. This involves leveraging both open social networks and private networks. By understanding how to navigate these platforms, researchers can conduct valuable studies.

Let’s explore both methodologies to advance our research goals and address their limitations effectively.

Private Social Media Networks

A private social media network is distinct from one that is open to the public like Facebook or LinkedIn. In a private network individuals must be invited to participate. This also typically means that all conversations that take place on the network are private to network members.

However these methods are expensive and take a lot of time to set up. They also require one-on-one access to a researcher.

Private social media networks can be excellent proxies for these more expensive qualitative research methodologies. This is sometimes called an “online research community” or an “online research micro-community.”

Setting up these networks is quite simple, making them a convenient option for researchers. Additionally, they are relatively easy to maintain compared to traditional focus groups. This is especially beneficial if you plan to conduct multiple studies throughout the year.

Creating Your Own Private Social Media Network

Imagine having a captive audience of your customers constantly engaged with your research team, ready to answer any questions within a few hours of being asked. Pretty nice, right?

You can get this type of access by setting up your own private network using network creation sites like Ning.

After creating your network, you can invite a select group of individuals who meet your audience criteria. They can participate for a specific duration in exchange for a reward or incentive. This arrangement encourages engagement and ensures valuable contributions to your research.

This kind of research is ideal for testing ad copy, billboards, and television ads, as well as shopping behavior and product preferences.

The best practice for these private networks is to rotate the population in the network on a fairly regular basis. In other words, your participants would only be required to be available for research questions for two or three months at a time (or possible even less). During this period they might receive a small stipend or gift cards as a reward for participating in the community.

Using the features of the social network for this type of research is great because it allows you as a researcher to ask a question and get immediate results. You can observe the group interacting and discussing the topics you present without incurring expenses for panels. There’s no need to call participants or coordinate a focus group. This allows for organic conversations and insights to emerge naturally.

It’s also beneficial to have participants use a format for discussion that they are familiar with, thanks to the pioneering efforts of public social networks like Facebook and Twitter.

Possibilities for Data Collection Using Public Social Networks

As an online market researcher, there are opportunities for you to use public social networks as well, as long as you proceed deliberately and carefully. For example, if you are conducting consumer research and have access to a public Facebook page with a substantial follower base, this can be a valuable opportunity. You can use this platform to distribute surveys, including a social media survey questionnaire, to a highly engaged group of individuals. This engagement can lead to richer insights and data collection.

If you choose this method it’s important to note that there is an expectation of reciprocity in the world of social media.

That is, there is an expectation that any participatory activity, including data collection, should result in content being added to the network.

Many market researchers that fail at getting repetitive respondents from social networks don’t keep this unspoken agreement. They use social media to collect survey data but don’t provide any information to the community in return.

At minimum you should post the results and allow respondents to discuss them amongst their peers.

Because it can take several weeks before you can share a summary of the results of your survey, this type of feedback loop may not work to fulfill expectations of reciprocity. As an alternative you could allow respondents to post their individual response to other people within the social network.

This has the additional benefit of giving your survey a chance to propagate virally.

Deciding if Social Media Surveys Are Right For You

There are really just two questions you need to answer to find out if you should investigate opportunities for gathering data via social media surveys.

- Do you have a broadly defined population? Social media networks, in order to be successful, are by nature not exclusive. Therefore, the broader your population definition the more likely a social media survey is to be useful. This isn’t just true for business to consumer surveys; there are now many business-to-business social networks as well.

- Is there a factor of fun or personal interest in the data you’re collecting? If the questions you’re asking in your survey would be of interest to the users of the social media network, then you have a chance for viral propagation of your survey. All you have to do is determine how you’re going to share the results, and if you are willing and able to do it in real time.

Have you successfully collected data via a social media survey? Share your experience with questions about social media surveys in the comments!

All research cited in this article is from the 2012 Online Research Benchmark Guide: Comparative Analysis on Survey Metrics, Techniques, and Trends compiled by Alchemer.