A how-to workbook to build a

finance-friendly CX business case

It’s no secret, the value of a great customer experience is well known and appreciated. Making customers happy is clearly good for business. This has been proven by a multitude of analyses, research and reports.

At a company-specific level, however, demonstrating the meaningful business outcomes of specific CX initiatives is difficult. Historically, CFOs teams often considered CX to be a cost center, not a revenue driver, and many CX teams have struggled to change their minds.

The CFO, of course, controls the purse strings. Finance makes decisions on budget cuts and expenditures, staffing, technology investments and more. When CX leaders translate customer experience goals, strategies, and KPIs into the CFO’s language, they increase the likelihood of securing the necessary resources. This alignment helps the CX team achieve success.

In this how-to guide, we’ll share how to advance your CX initiatives by building a strong relationship with your organization’s CFO and finance team. You will:

In addition, we’ve included prompts and recommendations to help you apply the ideas in the guide to your organization. Let’s get started.

Customer experience (CX) has never been more critical – or more complex. Customers’ expectations are constantly rising and evolving while products and solutions continue to become more commoditized. As our digital landscape expands, so does the number of touchpoints in a customer’s journey. Each of these touchpoints plays a crucial role in the overall experience.

The importance of an exceptional customer experience is clear. So why is it so hard to justify CX investments to the CFO?

We’ve found that a few dynamics tend to get in the way.

CFOs must strategically juggle long- and short-term priorities. In the short term, they’re responsible for quarterly or yearly updates to shareholders or their Board. They need to manage real-time cash flow, operational expenses, budgeting decisions, and risk. And with an average tenure of just over 3.5 years, they need to make an impact on the business quickly and decisively.

For CX teams, on the other hand, longer-term outcomes are often the norm. While quick wins are possible, most CX programs take considerable time to plan, test, execute, take effect, and measure. CX KPIs reflect this timeframe. When you measure the success of an initiative using metrics like customer lifetime value, it offers valuable insights. Projects that produce more timely outcomes may appear to be easier wins.

Finance teams and CX teams rely on KPIs that are unique to their roles and strategic focus. These metrics reflect how they see the world, what’s important to the business, and how they evaluate success.

For example, top KPIs for finance teams include:

On the other hand, CX teams have a narrower purview. Their primary KPIs include:

These CX metrics obviously impact the CFO’s numbers, but on their own, they can seem detached from Finance’s key objectives and priorities.

CFOs’ perception of CX as a cost center likely arose due to the challenge of measuring the impact of CX, especially in its early days. Technology and experience have introduced more effective ways to quantify the value of customer experience, and analysts continue to provide countless statistics. Yet, many still hold onto the same attitude.

Fortunately, addressing the first two issues on this list dramatically influences the third. By aligning Finance and CX with the strategies in this workbook, CX leaders can overcome outdated perceptions. This alignment fosters better communication and understanding between teams. It also positions CX as the driver of business value that it has become.

To bridge the gap between customer experience and finance, it helps to better understand the CFO’s perspective.

Modern CFOs still oversee the organization’s financial health. However, they also take on significant additional roles. These roles range from exploring new revenue streams to driving technological investments. CFOs are also responsible for meeting requirements around ESG, sustainability, regulatory compliance, and more.

Let’s take a closer look into the role of the Chief Financial Officer.

Today’s CFOs face a dynamic economic, geopolitical, and social environment. To address this, top CFOs are focused on scenario planning that prepares their organizations for each possible outcome, hopefully mitigating risk while uncovering opportunities to capitalize on whatever conditions become a reality.

CFOs are balancing the risks and benefits of AI. They see huge ROI potential in AI-powered tools but are also cautious of over-investing in “shiny new objects.” As a result, many CFOs are starting with clear use cases that create efficiency and cut costs while exploring how to leverage and measure AI going forward.

As CFOs become ever more important to the overall business direction, they must cultivate and trust their teams to tackle challenges, maximize productivity, and manage the day-to-day. This frees up the CFO to be a strategic leader alongside the CEO.

46% of finance leaders said cybersecurity and fraud prevention is a new responsibility they’ve taken on just this year. CFOs must now work closely with CIOs and other leaders to keep pace with the always-increasing volume and power of cyberattacks.

CFOs’ purview now very much includes technology as well. In 2025, financial leaders are focused on evaluating and consolidating tech stacks, centralizing processes, taking greater advantage of the cloud, and further embracing automation.

Getting on the same page as the finance team can take time and lots of discussion. It’s 100% worth it.

A collaborative partnership with the CFO can lead to:

Most CX leaders aren’t financial experts, and that’s perfectly fine. By working with Finance, CX teams gain essential insights into the cost allocation of customer experience initiatives. This collaboration helps align programs with the overall business strategy and budget, ensuring their future success.

In addition to strategic expertise, partnering with the CFO gives CX leaders a new perspective on data and KPIs. CFOs can provide new insights into customer-oriented metrics such as customer lifetime value, acquisition costs, and retention rates. This helps CX teams make smarter and more informed decisions. As a result, these decisions drive better top-line outcomes.

A CX-enlightened CFO can be a powerful advocate, especially in organizations without a CX executive, such as Chief Customer Officer or Chief Experience Officer. The CFO can act as a champion to:

According to Forrester, 41% of customer-obsessed companies achieved at least 10% revenue growth in their last fiscal year, compared to just 10% of less mature companies. To become customer-obsessed, you must first foster a customer-centric culture. CFOs can play a pivotal role by showcasing their commitment to CX and aligning the entire organization around delivering exceptional customer experiences.

When CFOs prioritize customer experience, the finance team can better balance short-term and long-term goals. While CFOs must focus on immediate results, their alignment with CX allows them to also consider the long-term value of customer experience. This strong partnership helps protect CX teams during downturns. Understanding how CX impacts the business makes CFOs less likely to cut budgets in ways that could harm the customer experience.

Get to know your CFO or another member of the finance team. Learn what makes them tick, what’s important to them, and what keeps them up at night.

Start with these five questions to get a better understanding of how your CFO sees CX:

With a better understanding of the CFO’s viewpoint, you can translate customer experience initiatives into language that resonates with the finance team – namely, metrics.

To transform your CFO into a CX champion, you need to connect your CX initiatives to KPIs that are related to financial outcomes. Below is a chart of common financial KPIs. Understanding these will help you identify how your programs move the needle.

What is it?

The total revenue or profit generated by a customer over the entire course of their relationship with your business.

Why does it matter?

CLV can help illuminate the long-term value of customer acquisition and retention, identify customer trends, inform marketing strategies and more.

How do you calculate it?

Customer value (average purchase value x average purchase frequency rate)

x

Average customer lifespan

=

Customer lifetime value

What is it?

The amount of money an organization spends to get a customer to purchase its products or services.

Why does it matter?

CAC helps businesses grow in a sustainable, scalable, and profitable way by revealing which channels work most efficiently and optimizing investments.

How do you calculate it?

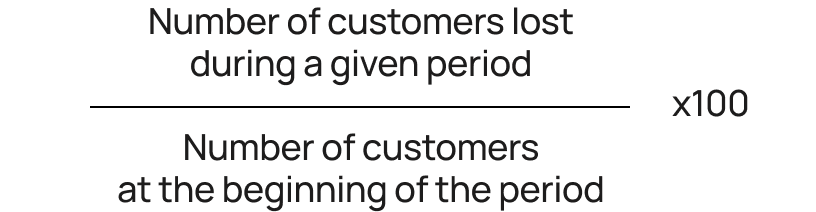

What is it?

The percentage of customers lost during a given period.

Why does it matter?

Churn rate can be an indicator of business problems such as poor CX, bad customer support, pricing issues, lack of product-market fit, or issues with features/functionality

How do you calculate it?

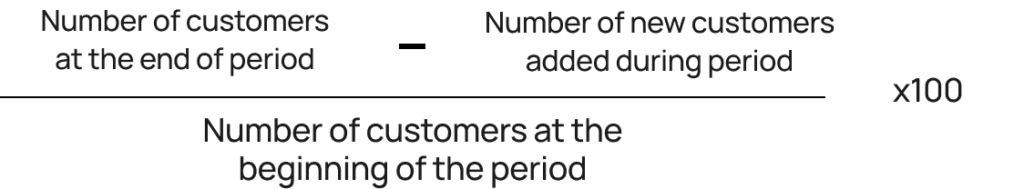

What is it?

The percentage of customers retained over a given period.

Why does it matter?

A high retention rate contributes to increased repeat sales and reduced acquisition costs.

How do you calculate it?

What is it?

A measurement of how much revenue each customer generates on average within a given timeframe.

Why does it matter?

Revenue per customer can be useful for identifying opportunities to increase revenue through upselling or pricing adjustments.

How do you calculate it?

Start calculating! If you haven’t been measuring the KPIs above, or haven’t done so in a while, dig into the data and see where you stand today.

Next, try to correlate your customer experience data and programs with the KPIs above. In other words, how did your CX programs influence customer acquisition cost or the customer churn rate?

of consumers would pay more for greater convenience

would pay more for a friendly, welcoming experience

find a positive experience with a brand to be more influential than great advertising

You can use numbers like these to demonstrate how CX initiatives affect key metrics. This can include the five metrics we highlighted above, or other relevant KPIs. By doing so, you show the direct impact on the finance team’s priorities.

Executives value knowing the impact on their particular organization. Consider how you can break down the data you’ve gathered from CX programs, such as surveys or sentiment analyses. The goal is to connect this data to the financial metrics you’ve calculated.

Another approach is to focus on a specific issue. For instance, if your survey data shows that customers are frustrated by slow shipping and unlikely to make a repeat purchase, you can use that information to improve shipping times. You’ll likely see a change in the survey responses, and more importantly, an increase in repeat customers – a direct impact to a financial KPI.

With this type of data, you can show the outcomes of past CX efforts AND more confidently project the ROI of future CX programs, which is a key component of our next topic: the business case for CX.

Calculate the ROI of a completed CX initiative

To calculate the basic ROI of a past CX initiative, first compare the cost of the CX program to the financial gains that it created to find the net financial impact of the CX initiative.

Then, divide the total net gain by the total CX investment costs and multiply it by 100 to get your ROI.

This calculation captures the return that the business saw for every dollar that you spent on the CX initiative. While the numbers and the cause-and-effect may not be quite as simple as these formulas, it can be a good place to start and a powerful data point for any CFO.

At the end of the day, the core reason to build rapport and understanding with the CFO and the finance team is to get funding approved for your CX programs. And to get funding approved, you need a business case. But not just any business case – a business case that will resonate with CFOs, their teams, and their peers and elevate your initiative above the rest.

What does that look like in practice?

This goes back to leveraging the CFO as a strategic advisor. As you think about what you want to accomplish and what it will take to achieve, talk to Finance. Ask for their input and build it into your strategy and assumptions so that you’re ahead of the game before the final business case makes it to the CFO’s desk.

Your proposal has a far higher chance of succeeding if it dovetails into objectives that are already on executives’ minds. Find out what’s most important to your company as a whole and its individual leaders in particular. Then either work backwards – think about how you could improve CX under that same umbrella – or forwards, connecting whatever you’d like to do to that initiative.

Instead of beginning your pitch with “I need X amount of money,” start with how your program will benefit the business. Describe the problem or opportunity in as much detail as you can. Use both metrics-based and narrative techniques to present the situation. First, share the data-driven insights that highlight the key numbers. Then, incorporate storytelling to bring the voice of the customer to life and provide context to the metrics. This approach helps make the data more relatable and impactful.

Explain the alternatives and why your plan of action makes the most sense. Consider providing options, tiered by cost or level of effort, and show how the impact of your program will differ based on the resources invested into it.

It can be particularly impactful to describe the cost of taking no action. Don’t be afraid to make reasonable assumptions about the direction the market may take. Consider what competitors might do, which trends are likely to prevail, and how technology is evolving. Explain how taking action early can provide long-term benefits for the business. Additionally, highlight why CX has become a strategic differentiator in today’s competitive landscape.

When building your business case, gather as many nitty-gritty details as possible. Provide specifics around budget, timing, key metrics, staffing requirements, and especially both short- and long-term projected ROI.

Budgets are always limited, and priorities are always changing. You won’t get every dollar that you ask for. But if they do pass on your CX business case, find out why. By uncovering the reasons, you may discover an opportunity to adjust your strategy. This could lead to a new CX initiative that better meets customer needs. Alternatively, you might gain valuable input on how to make your case stronger and more compelling.

To easily test the merit of your CX business case, Forrester VP Harley Manning recommends condensing it to one sentence:

If you can comfortably distill your business case down to that sentence and make a convincing argument, you’re probably in good shape.

Use the one-sentence business case formula to evaluate real or theoretical CX initiatives. Which one(s) make the strongest argument and why?

Washburn & McGoldrick Washburn & McGoldrick is a strategic consulting firm that helps higher education, museums, and healthcare organizations strengthen relationships and secure philanthropic funding.

Washburn & McGoldrick struggled to extract meaningful insights from thousands of open-text survey responses. Manual analysis was slow, costly, and prone to human bias, leading to inconsistent theme identification. They needed a powerful text analysis tool to process feedback efficiently, ensure accuracy, and uncover deeper alumni insights to drive engagement and donor participation.

Washburn & McGoldrick implemented Alchemer Pulse to automate open-text analysis, ensuring consistent, in-depth insights while cutting processing time in half. Pulse’s AI-driven approach captures nuanced sentiment, flags key issues, and eliminates human bias. Unlike other AI tools, Pulse places a strong emphasis on security. This allows universities to analyze feedback with confidence. As a result, they can deliver actionable insights that help boost alumni engagement and drive donor participation.

The solution delivered significant financial outcomes:

“We are delivering twice the value in half the time for our clients when it comes to comment analysis.”

— Dan Lowman, Senior Data Analytics Consultant at Washburn McGoldrick

Creating, fostering, and evolving a differentiated customer experience is a long-term game – and so is cultivating a relationship with the CFO and finance team.

As with any meaningful partnership, prioritize ongoing communication and transparency. Focus on continuously proving the short- and long-term value of your CX initiatives. Prioritize quick wins while continuing to measure progress over time. Prepare for unanticipated costs and build flexibility into your strategies. Most of all, remember that your ultimate goal is the same: to contribute to the success of the business. This can be best achieved through collaboration and creativity. Keep a laser focus on the customer, and don’t forget that some number crunching will be necessary along the way.

Now start building that business case. Your CFO is waiting.

Partnering with Finance isn’t just about getting funds approved. It can also include initiating ways for the business to reduce costs.

For instance, many CX teams rely on a mix of legacy technology solutions. These can include tools for surveys, dashboarding, text analysis, market research, analytics, and more. This is incredibly expensive in both time and money. It slows down processes, reduces productivity, limits capabilities, and requires the juggling of a myriad of contracts, integrations, fixes and updates and more. Using multiple solutions can be costly in terms of dollars. You often pay for tools with overlapping or underused capabilities. Additionally, you need to staff various resources to operate and maintain the complex web of solutions.

CX leaders can help finance teams save money – and dramatically amplify the power of their programs – by consolidating onto a modern customer experience and feedback platform like Alchemer. Alchemer enables CX teams with a unified platform for everything from surveys to research to AI-powered text analysis to Voice of the Customer feedback programs.

With Alchemer, you can:

Alchemer gives CX teams the features they need to transform feedback into business results while simplifying and reducing operational and financial burden for the business. We call that a win-win.

Alchemer has decades of experience helping brands turn feedback into action.

It’s no secret, the value of a great customer experience is well known and appreciated. Making customers happy is clearly good for business. This has been proven by a multitude of analyses, research and reports.

Please provide your name and email to continue reading.