Establish Baselines, Track Trends, and Benchmark Against the Best

You already have plenty of data—dashboards, charts, reports, and spreadsheets scattered across your different tools and systems. What you may not have is the clarity that turns all that information into action.

That’s because data alone doesn’t drive decisions. Benchmarking does.

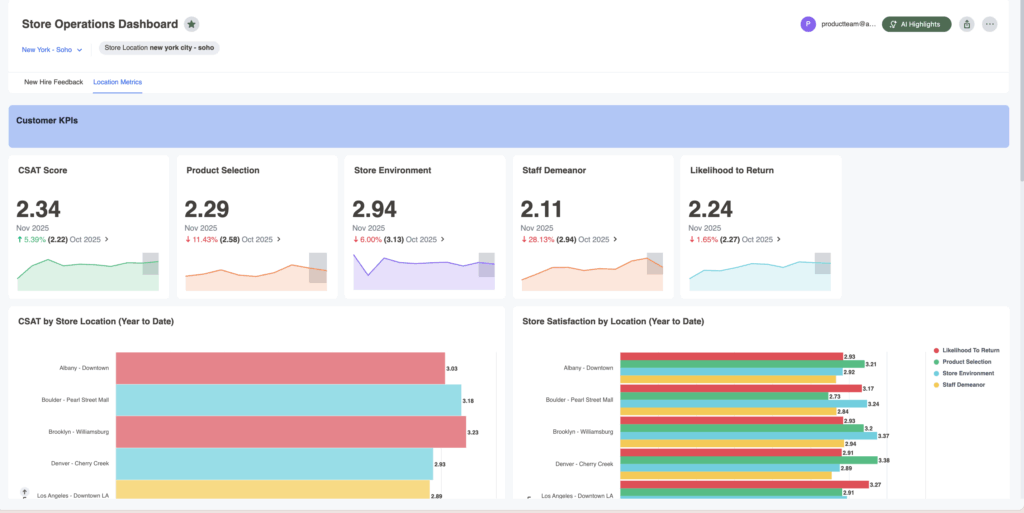

Benchmarking adds essential context to every metric, whether you’re focused on marketing, customer experience (CX), support, or sales. A conversion rate only becomes meaningful when you know how it stacks up against expectations. A CSAT score matters only when you know what “good” actually is. And a store or team is “underperforming” only when you have something reliable to compare it to.

In this guide, you’ll learn how to:

Before you compare yourself to anyone else—or even to your own goals—you need a clear picture of where things stand today. Think of this as the foundation of the house. Everything you build later depends on how solid this first layer is.

Start by identifying the KPIs that genuinely reflect how your business is performing. Avoid vanity metrics—focus instead on what truly drives decision-making and tells a story about growth, satisfaction, or risk. Start with the customer voice at the center. Key survey-driven metrics include:

Choose a regular rhythm for collecting and reviewing customer feedback. Some options:

Consistency ensures you catch meaningful trends instead of reacting to outliers.

Before you roll out a new feature, adjust prices, or overhaul a process, freeze-frame your current performance. Take a “before” snapshot of NPS, CSAT, and the top customer themes. Filter by product, region, or segment to create a clean baseline.

This baseline becomes your control. When the change launches, you can compare the “after” with confidence.

Once your baseline is set, use your dashboard tool to compare:

This view is where insights are found A 72% onboarding satisfaction score might look acceptable—until you see that it sits below your historical average, below your SMB segment, and below the industry benchmark.

A SaaS company with 60+ regional sales offices launched a new onboarding flow. Early usage numbers looked normal. Marketing felt good about the rollout. But once they compared the onboarding CSAT to the pre-launch baseline, a different story emerged.

Scores dropped 11 points among new enterprise customers. The issue wasn’t the workflow itself—it was that training materials hadn’t been updated in time for enterprise admins. SMB customers didn’t skip a beat, but enterprise teams were flying blind.

Because they had a reliable baseline, the discrepancy jumped off the page.

The ops team closed the training gap, and within a month, scores not only recovered—they surpassed the original benchmark.

Alchemer Dashboard delivers real-time, AI-powered insights that drive smarter decisions. Get a complete and actionable view of what’s working (and what’s not):

Once your internal view is clear, it’s time to look outward. Industry benchmarks help you answer a question every leader asks—“Is this good?”—and sometimes “Are we falling behind without realizing it?”

Your internal scores might be trending upward, but without external comparison points, you don’t know whether you’re improving faster than the market or just treading water.

Use industry benchmarks to:

You can pull from broad CX studies or specialized industry reports, depending on your sector and customer base. Sources include:

Modern dashboard tools streamline benchmarking by merging your data with external insights and surfacing patterns automatically. AI can help you:

Benchmarking gives your team the confidence to act quickly and the clarity to communicate results persuasively.

Alchemer by Chatmeter gives you the competitive intelligence to measure your performance against specific rivals—so you can see where you’re winning, where you’re falling behind, and what to do next.

Benchmarking only becomes powerful when it’s repeated. Tracking changes over time helps you confirm whether initiatives are working, spot early warning signs, and recognize long-term trends that may not be visible in snapshots.

To refine and track effectively:

Benchmarking drives results when teams understand the insights and know how to act on them. Clear communication turns data into alignment, accountability, and confidence.

Ways to communicate impactfully:

If your goal is to benchmark and act on feedback—not just collect feedback—Alchemer Dashboard is the tool that gets you there. Stop waiting on delayed reports or trying to stitch together siloed data. With always-on, connected insights, you can track performance over time, compare teams, products, or regions, and see exactly where you lead, where you lag, and what to fix next.

Interested in seeing how Dashboard can transform your feedback?

This e-guide is just one part of a multi-guide series and story. Use the links below to checkout the other guides!

Step 1: Setting the Foundation for an Effective Dashboard

Step 3: Question and Explore: Find the “Why” Behind Your CX Metrics

Step 4: Make a Change: Turn CX Insights Into Real Improvements

Step 5: Using Dashboards to Drive Change

Learn how to establish baselines, track trends in real-time, and benchmark against the best.

Please provide your name and email to continue reading.